march 2020

Op-Ed

The Black Friday remix: What 2025 will look like after a rule-changing 2024

By Rory Bosman, Chief Sales & Marketing Officer at Ecentric

In 2024, Black Friday stopped being an imported promo day in South Africa and started dictating terms. It was a supercharged, concentrated surge of shopping that reset expectations and rewired retail playbooks. According to the Ecentric Payment Systems’ Black Friday Index 2024, the four-day Black Friday to Cyber Monday window punched well above its weight with online transactions jumping from 7.9% to 10.3% – a 30.4% increase – while in-store revenue more than doubled to 11.1%.

The shape of the event has changed from a vague outline of some stores offering discounts to a firm discount buster with extraordinary sales volumes. Globally, Black Friday has become an almost month-long experience, something that has already started in South Africa, with Black November bringing promotions throughout. But these tend to be the start of the tail that leads to the weekend itself, where, as the report found, shopping has become concentrated over four days, whereas in the past, shopping would continue well into December. For the first time, the peak moved from early December, and the strongest returns were felt over the weekend.

This was a global trend as well. Shopify merchants alone processed more than $11.5 billion over the Black Friday weekend at a 24% year-on-year increase, and according to Adobe Analytics, Black Friday sales were up to $10.8 billion from $9.8 billion in 2023. Shoppers are saving their big-ticket purchases for that late November window and holding back on discretionary spending until the deals drop.

Yet the numbers only tell a part of the story. What made 2024 distinctive wasn’t just the scale and timing of spending, but the ways in which consumers chose to shop. Mobile devices have become the most popular storefront with millions of consumers transacting on their phones while on the move. At the same time, physical stores showed they could still pull in the crowds if they offered something beyond discounts. Festive atmospheres, interactive demonstrations and exclusive in-store promotions gave shoppers reasons to queue.

This resurgence of in-store retail in South Africa is particularly interesting. Ecentric’s Index showed that in-store revenue over the Black Friday weekend more than doubled its share of the holiday total. It suggests that while online convenience is still a winner, South Africans are enjoying the energy of a shopping trip when the experience feels worthwhile.

The rules of engagement are slowly changing. Mobile has to be rapid and easy with payment systems that can handle the extraordinary loads. Customers don’t want to lose deals because a payment system fails or websites can’t handle the load. This does leave a bad taste, and customers are vocal about disappointing experiences or the perception of false advertising. In-store experiences have to be equally smooth and satisfying. Sure, there will be queues, but let these be accompanied by working systems and easy access to stock and unexpected experiences.

Black Friday in 2025 is going to be as much about consumer delight as it is going to be about deals and discounts.

Customers also don’t see Black Friday as a novelty anymore. It has to work hard for its money. Flexible payment options are expected to become more popular, so price-sensitive consumers can benefit from the deals but stay within their budgets. Personalisation, powered by AI, is also going to get sharper and more effective with tailored promotions sent to devices in real time.

This year, intelligent tech, smart payments, faster checkouts and bigger deals are going to lead the way, but they will be supported by immersive experiences, deeper personalisation, and more excitement as retailers build on last year to create something completely transformative.

Afripreneur

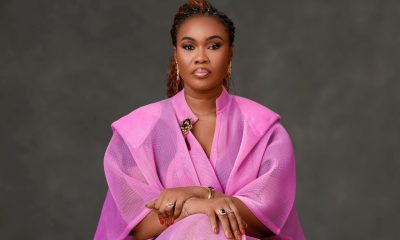

Revolutionizing Cross-Border Payments in Africa: An Exclusive Interview with Onyinye Olisah

Onyinye Olisah is the Founder and CEO of PayOnUs, the financial technology arm of Paylode Services Ltd, powering seamless cross-border payments across Africa and beyond. With over 19 years of experience in finance, banking, and fintech, she blends deep industry expertise with bold innovation in financial infrastructure. Under her leadership, PayOnUs has become a trusted payments enabler for merchants in high-volume sectors such as gaming, forex, e-commerce, and digital goods, processing transactions in more than 15 African countries. With a mission to simplify and accelerate international transactions, Onyiinye shares insights with Alaba Ayinuola of Business Africa Online (BAO) on the future of fintech, the challenges of navigating complex payment landscapes, and the opportunities for growth and innovation in the African market. Excerpts.

Alaba: What inspired you to start your fintech company, and what problems are you solving?

Onyinye: The foundation of PayOnus was built on a core vision: to unlock the economic potential of Nigeria and Africa by solving fundamental financial friction points.

My inspiration stemmed from observing three major gaps:

- Underservice to Small and New Businesses: We built PayOnUs with this category of businesses in mind. Payments is a high volume/count game and so all PayFacs are after those brands and business that already have the numbers and the transactions that went with it. The small business had to struggle for attention towards either onboarding or resolution of issues that impacted their growth at a critical point of their business. PayOnUs aims to identify the businesses that fall within this niche and grow with them.

- Growth Potential: We recognized that though the digital payments space had exploded exponentially in recent years, there was still room for growth for both SMEs and large enterprises, accepting and managing digital payments (whether card, bank transfer, or USSD) was often still slow, complex, and suffered from high failure rates. This fragmentation hindered commerce.

- Financial Exclusion: A significant portion of the population remained underserved, and a huge chunk of transactions were still cash based, limiting their ability to participate in the growing digital economy.

We are solving the following problems at PayOnus:

- Payment Reliability and Customer Service

- Creation of Financial Access

- Bridging the Digitization Gap

Alaba: What are the most significant challenges facing the industry in Africa, and how can they be addressed?

Onyinye: The most significant challenges facing the fintech industry in Africa stem from a combination of regulatory and operational friction points. The key issue is regulatory fragmentation, where rapid and often unpredictable policy changes from the regulator, particularly here in Nigeria, create a costly and complex compliance burden that severely restricts pan-African scaling.

We address this by establishing proactive regulatory engagement, not just for compliance, but to advocate for the harmonization of KYC/AML standards across the continent. Operationally, we grapple with significant infrastructure gaps and a lack of seamless interoperability between various payment systems, resulting in high transaction failure rates; our solution is to invest in technology-agnostic API infrastructure to ensure reliable service delivery regardless of local constraints.

Finally, persistent currency volatility and limited liquidity restrict cross-border trade, which we are tackling by developing localized treasury solutions and exploring the use of secure, regulated blockchain technology for B2B settlements to reduce traditional FX friction. This comprehensive approach transforms obstacles into opportunities for innovation and ecosystem building.

Alaba: How is your company contributing to financial inclusion and economic growth in Africa?

Onyinye: PayOnus is a direct engine for both financial inclusion and economic growth, addressing the fundamental need for reliable and accessible financial infrastructure across Africa.

We directly address the large unbanked and underbanked population through our proprietary technology:

USSD Accessibility: Our Pay with USSD service is a crucial financial inclusion tool. By leveraging this technology, we ensure that individuals and small businesses operating in remote areas or those using basic feature phones—who cannot access the internet or a bank branch—can still perform transactions, transfer funds, and paying merchants securely. This bridges the digital divide and provides a pathway into the formal financial system.

Tailored Services: Through our B2C focus, BankOnus, we aim to provide convenient, low-barrier banking and financial services designed specifically for the needs of the underserved, moving them from financial access to financial empowerment.

We create the rails for a truly cashless and digitally connected economy. By providing seamless, secure, and developer-friendly payment solutions, we facilitate both local and cross-border trade, lowering the cost of commerce and unlocking new revenue streams for enterprises across Nigeria and the wider African market.

what are the key pain points in remittance and cross-border payment processes in Africa and how can they be improved?

Alaba: What are the key pain points in remittance and cross-border payment processes in Africa and how can they be improved?

Onyinye: The key pain points in African cross-border payments are exorbitant costs, severe currency volatility, and deep regulatory fragmentation. Remittances suffer from transaction fees far exceeding global averages, often due to reliance on slow, opaque legacy correspondent banking systems. Furthermore, the lack of currency liquidity and unpredictable FX restrictions in markets like Nigeria inject significant risk and complexity.

Payonus and the industry are addressing this by:

- Bypassing intermediaries through API-driven, low-cost rails and utilizing regional systems like PAPSS to enable cheaper local currency settlement.

- Implementing real-time FX APIs and localized liquidity solutions to mitigate currency risk and provide instant price transparency.

- Partnering with other Payment Facilitators across Africa by collaborating on cross border payments and remittances across the continent, enabling seamless, instant, and secure trade and remittances.

Alaba: How do regulatory frameworks in Africa impact the development of fintech, remittance and cross-border payments?

Onyinye: The Nigerian regulatory framework has a dual and often contradictory impact on PayOnus and the fintech sector.

On one hand, it is a key enabler: CBN policies, such as the aggressive cashless drive and the support for channels like USSD and agent networks, have successfully forced rapid digital payment adoption and financial inclusion, creating a massive addressable market for our platform. Furthermore, the Regulatory Sandbox allows us to test innovative solutions in a controlled environment.

On the other hand, it imposes major constraints: The most critical challenge is policy volatility, particularly regarding Foreign Exchange (FX) controls. Frequent and complex shifts in guidelines for currency sourcing and repatriation, while aiming for economic stability, severely raise the cost, complexity, and operational risk of offering seamless remittances and cross-border payments, demanding continuous, resource-intensive compliance.

Alaba: What role can Fintech play in promoting financial inclusion in Africa and are there successful examples?

Onyinye: Fintech’s primary role in Africa is to be the greatest accelerator of financial inclusion, effectively bypassing the limitations of traditional, costly brick-and-mortar banking. It achieves this by focusing on accessibility, affordability, and relevance.

Fintech leverages ubiquitous mobile technology (even basic feature phones) to provide low-cost access to essential services like payments, savings, and credit, thereby creating a crucial digital financial identity for the previously excluded. Successful Examples;

- M-Pesa (Kenya/East Africa): The most famous example, which pioneered the Mobile Money model using USSD technology. It successfully onboarded over 80% of Kenya’s adult population into the formal financial system, proving the viability of mobile-centric financial services.

- Nigerian Payment Platforms: Companies in Nigeria focusing on API-driven payment processing (e.g., Paystack, Flutterwave) and digital banks (e.g., Kuda) have been instrumental in digitizing transactions for millions of MSMEs and individuals, accelerating the shift toward a cashless economy. This digitization of commerce is foundational to broader economic participation.

Alaba: How can fintech companies’ partner with traditional institutions to drive financial inclusion and innovation?

Onyinye: Partnerships between fintech companies and traditional financial institutions are essential for scaling financial inclusion and innovation across Africa. This collaboration is a strategic alignment known as coopetition, where each entity provides its unique strength. Fintechs contribute cuttingedge API technology, superior user experience (UX), and data analytics that enable new credit scoring models for the unbanked. In return, traditional institutions provide the required regulatory licenses, the underlying balance sheet liquidity, and deep expertise in risk management. This synergy enables the rapid, compliant roll-out of services like micro-lending and digital wallets to the mass market.

Furthermore, fintechs offer low-cost, mobile-first channels (like USSD), while banks contribute their vast existing physical agent networks (e.g., POS operators), effectively bridging the digital and physical divide to offer financial access to entrepreneurs and individuals outside of urban centers. The key is leveraging the fintech’s speed and innovation on the foundation of the bank’s trust and regulatory stability.

Alaba: Lastly, how do you measure the success of your company’s products and services?

Onyinye: As the CEO of a financial services company, our success measurement is grounded in a balanced score card that tracks both Commercial Viability and our core mission of Impact and Financial Inclusion.

These metrics demonstrate our commitment to the African market and our mission:

- Digital Adoption Rate (Inclusion): Tracking the number of previously unbanked individuals and MSMEs brought into the formal financial system via our low-barrier products, particularly Pay with USSD and BankOnus accounts.

- Interoperability Index: Measuring our connections with local banks and regional systems (like PAPSS), ensuring our payments can reach every corner of the African financial ecosystem efficiently.

- Fraud and Chargeback Rate: Maintaining a low rate is crucial, as it builds consumer and regulatory trust, which is foundational to the security and integrity of the financial system.

Oil and Gas

TotalEnergies, Chevron Push for Faster Permits, Better Seismic Data in Africa

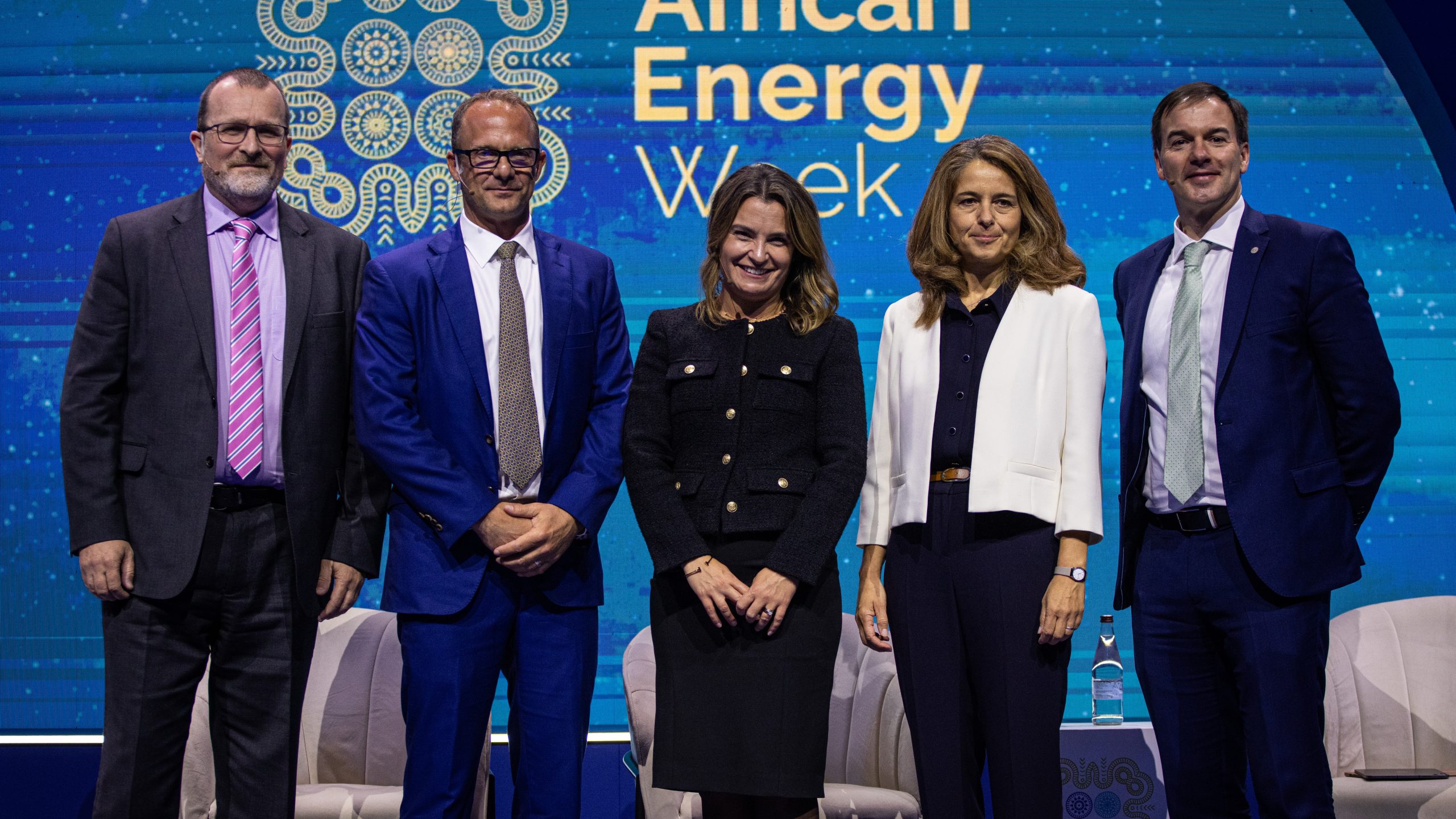

Africa’s oil and gas sector could be on the brink of a new exploration renaissance, driven by advances in seismic imaging, frontier data sets and faster permitting, industry leaders said at Africa Energy Week (AEW): Invest in African Energies 2025 in Cape Town on Wednesday.

According to Emmanuelle Garinet, VP of Exploration Africa at TotalEnergies, Africa’s frontier basins hold significant volumes. She pointed to Namibia as an example of how seismic and subsurface data can de-risk projects: “When we decided to drill the Venus well, it was frontier, but we had a probability of success of more than 50% because of the seismic data and direct hydrocarbon indicators.”

In the Republic of Congo, TotalEnergies’ exploration permitting process is moving at a markedly faster pace. “We got our permit in less than six months and are preparing for drilling by the end of the year,” Garinet said. By contrast, South Africa’s permitting system has faced delays due to legal challenges, a problem she described as “unacceptable” given limited budgets for global exploration.

Chevron’s CEO, Gavin Lewis, emphasized the critical role of comprehensive subsurface datasets in Africa. “Before you can do any AI-driven workflows, you need a dataset that illuminates what the subsurface looks like,” he said. “What Africa has lost is the ability to sponsor multi-client subsurface datasets. The only basin that allows for large, regional high-quality datasets is the Gulf of America, which has allowed that basin to reinvent itself multiple times.”

VP of Exploration for bp, Bryan Ritchie, highlighted survey work in Egypt’s Nile Delta, where the company completed the first deepwater ocean-bottom node seismic survey over the Atoll field and noted that the Egyptian Natural Gas Holding Company plans to expand multi-client data coverage across a larger area of the delta. ‘We’re seeing new opportunities for these images,” he said.

Beyond exploration, Woodside Energy’s VP of Exploration, Terry Gebhardt, said geoscience and subsurface data are also key to carbon capture and storage projects, as well as “maximizing efficacy and recovery” in existing fields.

The panel discussion, sponsored by EnerGeo Alliance, also underlined the broader scale of investment in Africa’s oil and gas sector. Nikki Martin, President and CEO of EnerGeo Alliance, said African oil and gas capital expenditure is expected to rise to $54 billion by 2030, following a $6 billion surge in exploration spending in 2024.

-

Afripreneur23 hours ago

Afripreneur23 hours agoRevolutionizing Cross-Border Payments in Africa: An Exclusive Interview with Onyinye Olisah

-

Oil and Gas3 days ago

Oil and Gas3 days agoTotalEnergies, Chevron Push for Faster Permits, Better Seismic Data in Africa

-

Energy3 days ago

Energy3 days agoUnited States (U.S.) Political Will, African Reforms Signal New Era for Energy Investment

-

Op-Ed1 hour ago

Op-Ed1 hour agoThe Black Friday remix: What 2025 will look like after a rule-changing 2024