Investing

African Guarantee Fund Secures $20 Million Capital Increase for Green SME Financing

African Guarantee Fund CEO, Jules Ngankam and IFU’s CEO, Torben Huss (Source: African Guarantee Fund)

African Guarantee Fund has today received a capital increase of USD 20 million from the Danish Investment Fund for Developing Countries (IFU) to facilitate green SME financing in Africa. The capital increase is partially financed by the Danish Government, as part of the Danish “COVID-19 Development Assistance” package. Including the additional USD 20 million, the total Danish investment in AGF amounts to USD 72 million.

The capital increment into the African Guarantee Fund will increase the Fund’s capacity to unlock financing for Small and Medium Enterprises (SMEs) in Africa. SMEs in the continent have experienced a deterioration in their creditworthiness as a result of the economic impact of Covid-19. The United Nations Economic Commission for Africa 2020 survey reports business closure, lack of operational cashflow and a drop-in demand as the top challenges facing African SMEs as a result of the pandemic.

“The initial Danish capital injection into the African Guarantee Fund not only generated economic and social impact but also helped to attract more capital from other Development Finance Institutions. AGF is currently supporting financial institutions and SMEs to contain the impact of Covid-19 and to eventually recover in the post-covid context. Our target is to keep SMEs afloat while maintaining their workforce; and to ensure SMEs’ green transition. With this capital increment, our capacity to offer more green guarantees to financial institutions is enhanced and will facilitate sustainable financing for green transition in Africa” said AGF’s CEO, Jules Ngankam.

“Private SMEs are vital for creating and safeguarding decent jobs in Africa, but they face huge challenges in the Covid-19 crisis. AGF is well placed to ease the negative consequences and help African SMEs to build back better and greener. IFU´s 20 million dollars investment provide funding of SMEs´ green transition, making more companies fit for a low carbon climate resilient future and create jobs. We are confident that our investment will attract other investors to exploit the proven potential of AGF filling the huge gap in SME financing in Africa,” said IFU’s CEO, Torben Huss.

AGF’s key objective is to reduce the SME financing gap currently estimated at more than USD 300 billion. With IFU’s capital increase, AGF will be able to achieve even more economic and social impact, given the investment will unlock more than USD 400 million of financing for SMEs.

Investing

Goodwell Investments leads USD 8.5 million Series B round for Good Nature Agro

Impact investor Goodwell Investments has joined forces with social impact investing cooperative Oikocredit and Global Partnerships/Eleos Social Venture Fund (GP SVF) to provide USD 8.5 million in equity to Zambian social enterprise Good Nature Agro (GNA).

Good Nature Agro currently supports about 30,000 southern African smallholder farmers in growing drought-resistant, early-maturing legume seed varieties, including beans, cowpeas, soyabeans and groundnuts. Its agritech-based business model encompasses access to inputs, input finance, smart and reduced fertiliser use, climate-smart training, and a guaranteed market for high-value produce, giving farmers a wealth of support to professionalise their businesses and establish a clear path out of poverty.

In line with Goodwell’s mission to support innovative African companies that are contributing to a more inclusive society, the organisation first invested in Good Nature Agro in 2020 via its uMunthu I fund. In the years since, GNA has continued to expand its ambitions and reach, consistently growing farmers’ productivity and incomes, as well as improving their access to finance. In addition, the company has recently opened a new factory in Lukasa.

To enable GNA’s next phase of growth, Goodwell Investments led the company’s series B round, partnering with Oikocredit and GP SVF to raise a total of USD 8.5 million. With this new investor capital, GNA aims to grow its client base to 50,000 farmers by 2027. It will also deepen its engagement with its clients, improve its integration of whole farm income, develop new genetics to deliver greater yields and resilience, and innovate to keep its clients at the centre of agricultural supply chains.

Neo Maruatona Ratau, the Investment Director at Goodwell Investments, eagerly anticipates GNA’s future accomplishments, stating, “The remarkable growth GNA has experienced since our initial investment has been impressive. We have observed the company’s ability to deliver robust financial returns and make a significant social impact, all thanks to its farmer-centric business model, which effectively integrates smallholder farmers into the agricultural value chain. We are delighted to collaborate with investors Oikocredit and Global Partnerships to support GNA’s upcoming growth phase, which will be fueled by the convergence of digital and financial inclusion, along with strategic inorganic growth initiatives.”

Samuel Kibiri, Oikocredit’s Equity Officer for Africa, is equally enthusiastic about GNA’s potential for creating impact, saying, “Our new partnership with Good Nature Agro will enable Oikocredit to help more low-income African farmers improve their livelihoods through improved yields and access to markets. We’re delighted to be co-investing with like-minded investors in an innovative business with a clear mission to move farmers out of poverty.”

Finally, Jim Villanueva, Managing Director of GP SVF at Global Partnerships, is confident in GNA’s ability to continue to deliver remarkable results, saying, “We first invested in GNA during their seed round in 2018 and have witnessed the enterprise’s ability to adapt and scale its offering to enable farmers to increase and diversify their incomes, in the face of both climate change and gender inequality. We are proud of the results achieved to date and the opportunity to support GNA in this next chapter of growth and impact.”

Reflecting on the new investment, Carl Jensen, CEO of Good Nature Agro comments, “Good Nature has broken the boundaries of most agribusinesses by engaging the full value chain – connecting growers, aggregators, processors and consumers – and delivering exceptional service through a hybrid tech and ‘boots on the ground’ model. We very much welcome Oikocredit as a new investor, endorsing our approach and potential, and are equally grateful for the partnership and trust of our existing investors Goodwell and GP SVF who participated in this round.”

Investing

Egypt’s BONBELL seeks $10 million seed funding after closing $350,000 initial round

Egypt’s startup BONBELL, the first mobile App in the Food-tech industry specialized in food ordering, digital solutions for table and meal reservations, has closed an initial funding round for $350,000. This is through a Canadian Angel investor, to help further develop the App services and achieve a level of growth in regard to user count and daily orders.

BONBELL launched its own App in early 2022, to offer a wide range of food ordering services in Egypt. The App offers many food ordering solutions, from food delivery to restaurant’s reservations and Dine-in ordering through a QR Code on the tables, as well as take away services. The App offers various payment solutions through cash or credit cards.

BONBELL has partnered with many restaurants and cafes, as well as clubs like Heliopolis Club and Smash Club. It also offers its services in Malls and Cinemas, to offer a smoother food ordering experience, reserving tables and food delivery, for mall and cinema goers. It has also strategically partnered with many leading major companies and institutions. Most notably the German University in Cairo (GUC), and Raya Telecom, in order to offer its services in their respective headquarters for employees and visitors alike.

The Food-Tech startup targets raising its partnered restaurants to 750 by the end of 2022. The company is also negotiating with two venture capital funds from Europe and the Gulf, to close a $10 million fund in its seed round by the end of the year.

Doaa Abdel-Hameed, the Chief Business Officer of the company said: “we aim to help restaurants in offering an easier food ordering experience to their customers. Either through food delivery or reserving a table in the restaurant, as well as taking away orders and also the special orders made by customers in their restaurants.”

“We pursue a better experience for the Egyptian user in food ordering. We see a lot of potential and opportunities to do that through developing the App constantly based on the user reviews. And adding more restaurants in all of the Egyptian governorates.” She added.

BONBELL has earned the trust of more than 12,000 customers, who used the app in food ordering in all the ways offered through the App, in just 6 month.

Doaa Abdel-Hameed emphasized that the success of BONBELL App, in offering the best experience to its users can only be done through strategic partnerships with many more restaurants. In addition to the constant development of the technology used in the App, as well as relying on offering inventive solutions to the Egyptian user such as (Robotic Stations) service.

This service will offer customers the experience of food ordering and serving through a Robot, without any human intervention. It is expected to launch in Egypt at the end of 2023.

Investing

Dream VC applications: A peek behind the scenes

Dream VC breaking down the numbers and representation in its programs

A year ago, Dream VC quietly launched its first inaugural cohort applications with the hopes of closing the investing knowledge gap for check-writers and ecosystem builders across the continent. Fast forward one year later, they have received an overwhelming amount of interest from people curious about investing and contributing to the African startup ecosystem. Across two cohorts alone, they have processed more than 2000 applicants from 30 African countries. With fellows dialing in five continents and multiple time zones.

That being said, they’d like to share some interesting findings they have extracted and learned from the whirlwind that Dream VC has been in from last year to now.

Cohorts

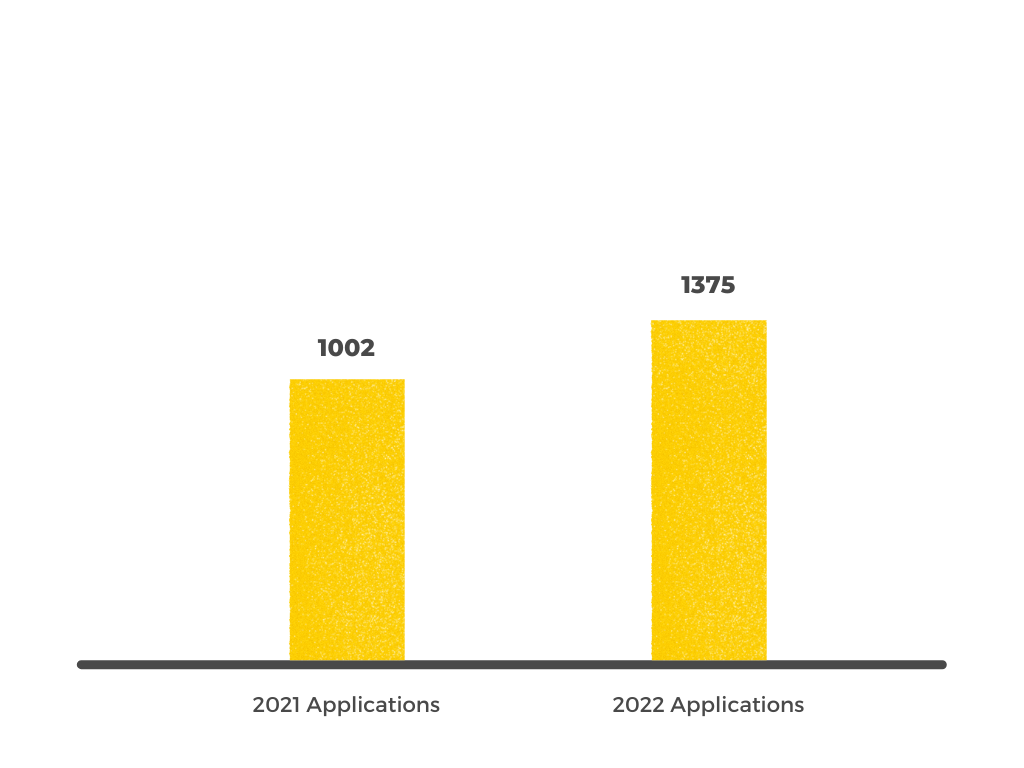

By the end of 2022, Dream VC will have 2 cohorts under its belt with 3 programs run. There has been an increase in total applications despite the difference in price point between the 2021 program and this year.

Breakdown Of The 2021 Cohort

For its inaugural cohort, they received a total of 1002 applications and had an intake of 31 fellows, with an acceptance rate of 3%. The average age of its fellows was 25, with most being in their mid-twenties to late twenties. And exploring VC as a new career pivot after a few years of full-time work experience. After 4 months of rigorous and community-driven engagements, a total of 19 Fellows graduated from the program with an issued certification.

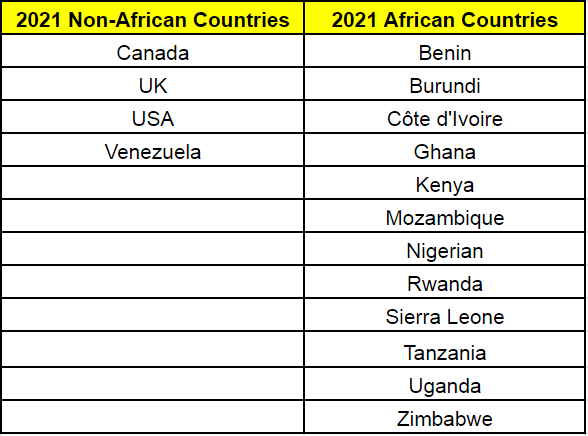

When looking at the specific demographics of Dream VC’s inaugural fellows, findings show that 90% of the fellows were homegrown. Which they classified as having been born, raised, and educated on the continent. They also had 12 African countries represented and 16 different Nationalities in total.

Although its initial intake consisted of 33% women, the final certified graduating fellows consisted of 60% women. Meaning that all of the female fellows who joined the fellowship finished the program.

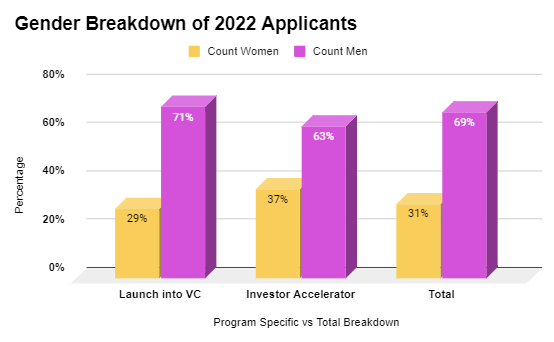

This is a strong indication of the perseverance of its female fellows in particular. And they are committed to making a strong push to convert more women into its talent pipeline. Especially given that only 15% of the 2021 applicants identified as female. At Dream VC, they urge more women to apply for its programs and also reapply for future cohorts if they were not accepted initially.

Breakdown Of The 2022 Application Cycle

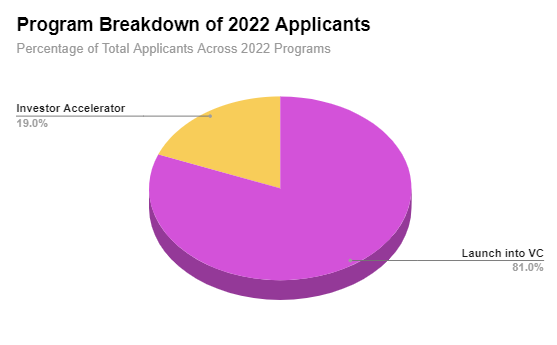

For 2022, Dream VC opened its applications on March 8th and had then remained open for over a month and a half until its final deadline on May 1st. In total, they received a total of 1,375 applications for its Launch into VC (“LIVC”) and Investor Accelerator (“IA”) programs.

Around 81% of the total applications were for our Launch into VC fellowship, and the remaining 19% were for the Investor Accelerator. We received a total number of 1,113 applications for Launch into VC, and 262 for Investor Accelerator.

Gender Breakdown

Out of the total applications for 2022, 31% of the applicants identified as female. When taking a closer look at the gender breakdown for each program, Investor Accelerator had a higher percentage of female applicants with 37% of total Investor Accelerator applicants, while Launch into VC had 29%.

Nationality Breakdown

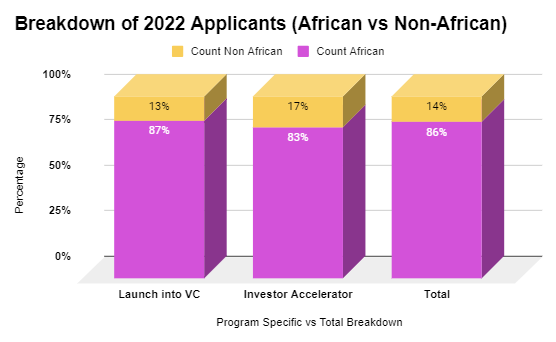

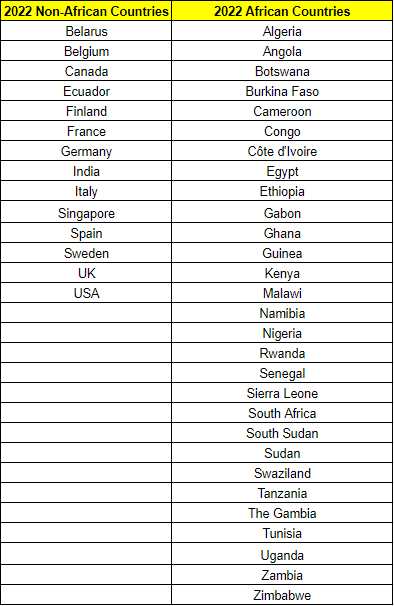

When reviewing the nationalities of the applicants, it was found that for 2022, Dream VC has exponentially expanded its reach of applicants in both nationality and location. However, most of the applicants are still overwhelmingly from the continent and diaspora, which accounts for 86% of the total applicants. The remaining 14% hail from non-African countries such as India, Singapore, and Germany with non-African backgrounds.

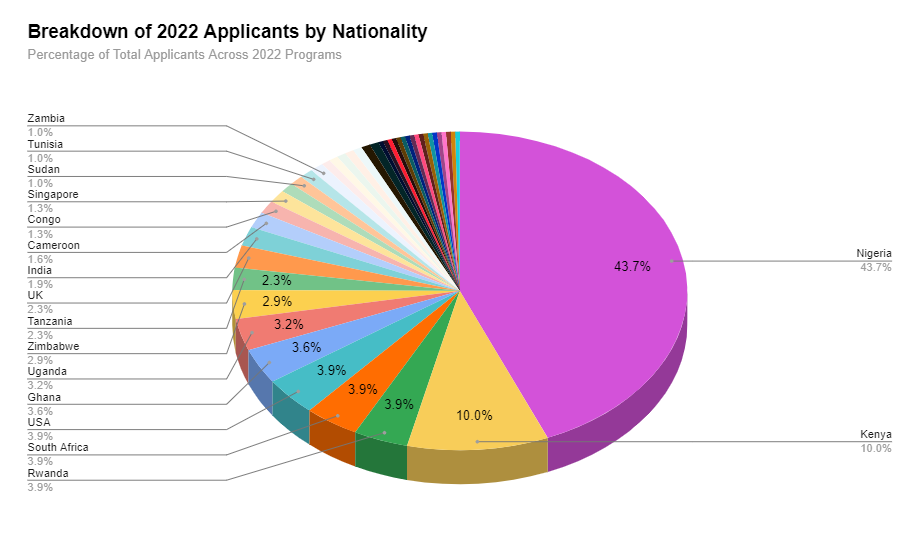

When looking more closely at each program, 87% of the applicants for Launch into VC applicants were homegrown or African diaspora, compared to 83% of the Investor Accelerator applicants. This year saw 30 different African countries across the continent represented. With a majority of the applicants coming from Nigeria (43.7%), followed by Kenya (10%), Rwanda and South Africa (3.9% each respectively), Ghana (3.6%), Uganda (3.2%), Zimbabwe (2.9%), and Tanzania (2.3%).

Interestingly, the country represented the most by the diaspora applicants was Cameroon, followed by Nigeria, across both programs.

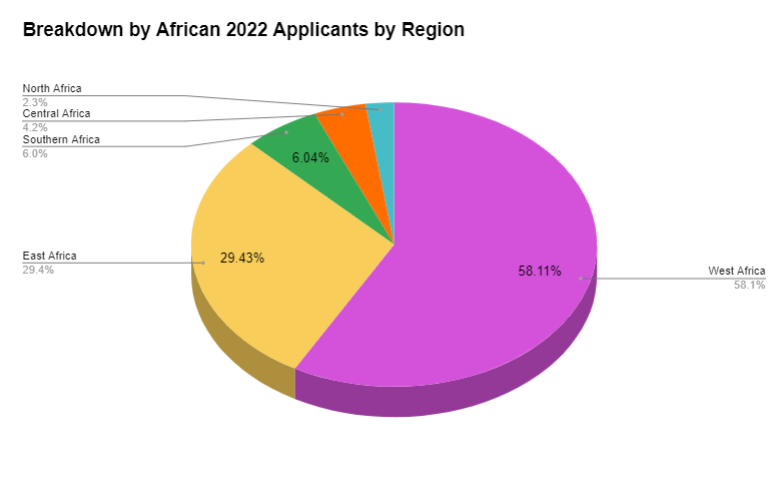

Across the different African regions, West Africa took the lead in applicants with over half of the applicants hailing from the region (58%). East Africa contributed to another quarter with approximately 29% of applicants coming from the area, followed by Southern Africa (6%), Central Africa (4%), and finally North Africa (2%). Dream VC’s footprint can still be solidified further, particularly in the ecosystems in North Africa, and its team will be traveling actively to Egypt, Morocco, and Tunisia to build relationships there.

Locations Breakdown

When looking at the locations of applicants applying from outside the continent (including diaspora and non-Africans), over 50% of them applied from the United States and the United Kingdom. Dream VC also saw an increase of Indian and Singaporean applicants from Asia. And a spread of interesting European countries including Belgium, Belarus, Germany, France, Finland, and Sweden.

Closing Remarks & Reflections

Since launching Dream VC in 2021, the team has been endlessly grateful for the overwhelming interest from the African & International community. As well as the selfless support that has been extended by various ecosystem partners and connections in our network.

Its application cycles have revealed several interesting insights into where the strong interest can be found in various startup ecosystems. As well as certain areas we are endeavoring to have better reach in (ex: North Africa and Arabophone countries).

They also strongly encourage more female applicants to apply AND reapply to its programs. As they are strongly committed to building out the opportunity and talent pipeline for black women in particular focused on investing in Africa.

-

Op-Ed2 days ago

Op-Ed2 days agoSam Tayengwa: Navigating the Future of Insurance in Africa

-

Corporate Citizenship2 days ago

Corporate Citizenship2 days agoHuawei 2024 ‘Seed for Future’ Programme Kicks off in Kenyan Tertiary Institutions

-

Press Release2 hours ago

Press Release2 hours agoTelCables’ Partner Program is shaping the future of digital connectivity in West Africa