Investing

Baker McKenzie outlines shifting patterns of infrastructure funding in Africa

Baker McKenzie latest report – New Dynamics: Shifting Patterns in Africa’s Infrastructure Funding – shows the state of the African infrastructure market, and how the major global players’ approach infrastructure lending on the continent is changing. While the IJ Global data shows a decline in the value of infrastructure lending, it is expected that as economies recover, new types of financing will be unlocked.

The data

The report’s data shows that multilateral and bilateral lending into Africa has declined – with investment levels falling successively in 2019 and 2020 compared to peak levels seen after the financial crisis. In 2019, bilateral and multilateral lending into Africa amounted to USD 55 billion, which drops to USD 31 billion in 2020. Over the last six years, the decline is significant – deal values dropped from USD 100 billion in 2014 to USD 31 billion in 2020.

This slowdown in infrastructure investment was attributable to a number of factors, including the pandemic. Economic contraction has affected Nigeria and South Africa, meaning that the region’s largest economies have not been feeding in growth as in previous years. However, market fundamentals signal a region with underlying resilience and, as the global economy recovers, finance will be unlocked. There are already positive indicators of forthcoming investment. Commodity prices are rising and landmark deals are returning. For example, mining multinational Sibanye-Stillwater recently committed ZAR 6.3 billion to South African infrastructure projects.

The data also shows that deal tenor is contracting – from a high of 17 years in 2019 to 13 years in 2020. However, the long-term nature of infrastructure projects means that international partners have made lasting commitments to the region, which are unlikely to be abandoned despite immediate pressure on national finances.

China

Surprisingly, given the pandemic, the data shows that lending by Chinese banks into energy and infrastructure projects in Sub-Saharan Africa saw a small uplift in 2020, although deal values are well below their 2017 peak. In 2017, Chinese banks lent USD 11 billion to African infrastructure projects, which decreased to USD 4.5 billion in 2018, USD 2.8 billion in 2019 and USD 3.3 billion in 2020.

Simon Leung, Partner, Baker McKenzie Hong Kong, explains, “There has been a slowdown in the number of infrastructure deals from China. In the short-term, we expect to see more targeted lending – fewer projects of a higher quality using sophisticated structures – and new finance options, such as factoring, used to deploy Chinese capital into the region.”

International players

It is also clear that other international players have the region in their sights, with key political changes in the United States (US) and United Kingdom (UK) likely to see capital flow into Africa.

Michael Foundethakis, Partner and Global Head of Projects and Trade & Export Finance, Baker McKenzie Paris, notes, “The US hasn’t kept pace with Chinese lending into Africa. The recent change in administration is likely to renew focus on impact-building and financing strategic long-term projects in the region, but bankability and risk-sharing remain a priority for US lenders.”

Lodewyk Meyer, Partner, Baker McKenzie Johannesburg, notes further that, “The infrastructure funding gap is so large and of such strategic importance, it remains necessary to encourage international investment to fill it. African DFIs are very good at collaborating and I am encouraged by the actions of the new US administration, UK government and New Development Bank, in particular in their willingness to work with regional institutions in this regard. The UK is making a strong play for influence, investment and trade with Africa post-Brexit. Further to key summits held in 2020 and 2021, there are signs that finance will be redirected into Africa.”

Commercial banks

The report points to infrastructure gaps in energy provision, internet access and transportation that have resulted in an urgent imperative to identify and enable new sources of finance outside traditional lenders and international partners. Further to the expected return of multilateral and bilateral lending, there is room for evolution to bridge the funding-opportunity gap.

The report shows, however, that this vacuum is unlikely to be filled by commercial banks, noting that in 2020, just 84 projects were supported by commercial bank finance and their involvement in Development Finance Institution (DFI) and Export Credit Agency (ECA) deals continues on a downward trend.

Luka Lightfoot, Partner, Baker McKenzie London, explains, “Banks are likely to be focusing on managing liquidity, with lenders deploying capital selectively.”

DFIs and new financing solutions

Instead, local and regional banks, specialist infrastructure funds and private equity and debt are stepping in to collaborate with DFIs and access returns. This outlines the deepening DFI involvement in the infrastructure ecosystem at large, with DFIs increasingly anchoring the infrastructure ecosystem in Africa – serving a critical function for project finance as investment facilitator and a check on capital. This is because they can shoulder political risk and access government protections in a way that others can’t, enter markets others can’t and are uniquely capable of facilitating long-term lending.

The report explains how the amount of capital needed to fill the infrastructure gap is significant and DFIs can’t bridge it alone. Private equity, debt finance and specialist infrastructure funds are primed to enter the market, and multi-finance and blended solutions are expected to grow in popularity as a way to de-risk deals and support a broader ecosystem of lenders.

Lightfoot comments, “We expect to see an increase in non-bank activity in Africa in future as a result of new credit mitigation products come to market. We have seen an increase in appetite from established market participants, such as development banks, to create products that are not tied to existing arrangements that may have limited the type of finance available.”

A new era

Lamyaa Gadelhak, Partner and Co-head of Banking, Finance and Projects at Helmy, Hamza & Partners, Baker McKenzie Cairo,adds, “The pandemic represents the end of an era and the start of a new one. There will be a re-prioritization of funds and strategy through this lens. I expect to see more investments in the healthcare industry and connected infrastructure, as well as water related projects, to be top priority. We should also consider the impact of other factors aside from the pandemic. For instance, the African Continental Free Trade Agreement and what it needs to translate into increased cross-regional trends. I would expect development of transportation and logistics infrastructure focused projects to enable the acceleration of on-ground execution of intra-African trade.”

Emeka Chinwuba, Partner, Baker McKenzie New York, and Banking, Finance & Major Projects Group member, concludes, “Last year was a relatively difficult year across jurisdictions and for investors – with considerable uncertainty and change in the ways in which we do business. Shutdowns had a depressant effect on the infrastructure market, as deals in the pipeline were delayed and projects halted as a result of COVID-19. Full vaccination in Africa is still quite a long way off comparatively, so we can’t expect a full and fast return to normal activity. But we’ve reached the bottom, and the only way is up.”

Article by Baker McKenzie

Investing

Goodwell Investments leads USD 8.5 million Series B round for Good Nature Agro

Impact investor Goodwell Investments has joined forces with social impact investing cooperative Oikocredit and Global Partnerships/Eleos Social Venture Fund (GP SVF) to provide USD 8.5 million in equity to Zambian social enterprise Good Nature Agro (GNA).

Good Nature Agro currently supports about 30,000 southern African smallholder farmers in growing drought-resistant, early-maturing legume seed varieties, including beans, cowpeas, soyabeans and groundnuts. Its agritech-based business model encompasses access to inputs, input finance, smart and reduced fertiliser use, climate-smart training, and a guaranteed market for high-value produce, giving farmers a wealth of support to professionalise their businesses and establish a clear path out of poverty.

In line with Goodwell’s mission to support innovative African companies that are contributing to a more inclusive society, the organisation first invested in Good Nature Agro in 2020 via its uMunthu I fund. In the years since, GNA has continued to expand its ambitions and reach, consistently growing farmers’ productivity and incomes, as well as improving their access to finance. In addition, the company has recently opened a new factory in Lukasa.

To enable GNA’s next phase of growth, Goodwell Investments led the company’s series B round, partnering with Oikocredit and GP SVF to raise a total of USD 8.5 million. With this new investor capital, GNA aims to grow its client base to 50,000 farmers by 2027. It will also deepen its engagement with its clients, improve its integration of whole farm income, develop new genetics to deliver greater yields and resilience, and innovate to keep its clients at the centre of agricultural supply chains.

Neo Maruatona Ratau, the Investment Director at Goodwell Investments, eagerly anticipates GNA’s future accomplishments, stating, “The remarkable growth GNA has experienced since our initial investment has been impressive. We have observed the company’s ability to deliver robust financial returns and make a significant social impact, all thanks to its farmer-centric business model, which effectively integrates smallholder farmers into the agricultural value chain. We are delighted to collaborate with investors Oikocredit and Global Partnerships to support GNA’s upcoming growth phase, which will be fueled by the convergence of digital and financial inclusion, along with strategic inorganic growth initiatives.”

Samuel Kibiri, Oikocredit’s Equity Officer for Africa, is equally enthusiastic about GNA’s potential for creating impact, saying, “Our new partnership with Good Nature Agro will enable Oikocredit to help more low-income African farmers improve their livelihoods through improved yields and access to markets. We’re delighted to be co-investing with like-minded investors in an innovative business with a clear mission to move farmers out of poverty.”

Finally, Jim Villanueva, Managing Director of GP SVF at Global Partnerships, is confident in GNA’s ability to continue to deliver remarkable results, saying, “We first invested in GNA during their seed round in 2018 and have witnessed the enterprise’s ability to adapt and scale its offering to enable farmers to increase and diversify their incomes, in the face of both climate change and gender inequality. We are proud of the results achieved to date and the opportunity to support GNA in this next chapter of growth and impact.”

Reflecting on the new investment, Carl Jensen, CEO of Good Nature Agro comments, “Good Nature has broken the boundaries of most agribusinesses by engaging the full value chain – connecting growers, aggregators, processors and consumers – and delivering exceptional service through a hybrid tech and ‘boots on the ground’ model. We very much welcome Oikocredit as a new investor, endorsing our approach and potential, and are equally grateful for the partnership and trust of our existing investors Goodwell and GP SVF who participated in this round.”

Investing

Egypt’s BONBELL seeks $10 million seed funding after closing $350,000 initial round

Egypt’s startup BONBELL, the first mobile App in the Food-tech industry specialized in food ordering, digital solutions for table and meal reservations, has closed an initial funding round for $350,000. This is through a Canadian Angel investor, to help further develop the App services and achieve a level of growth in regard to user count and daily orders.

BONBELL launched its own App in early 2022, to offer a wide range of food ordering services in Egypt. The App offers many food ordering solutions, from food delivery to restaurant’s reservations and Dine-in ordering through a QR Code on the tables, as well as take away services. The App offers various payment solutions through cash or credit cards.

BONBELL has partnered with many restaurants and cafes, as well as clubs like Heliopolis Club and Smash Club. It also offers its services in Malls and Cinemas, to offer a smoother food ordering experience, reserving tables and food delivery, for mall and cinema goers. It has also strategically partnered with many leading major companies and institutions. Most notably the German University in Cairo (GUC), and Raya Telecom, in order to offer its services in their respective headquarters for employees and visitors alike.

The Food-Tech startup targets raising its partnered restaurants to 750 by the end of 2022. The company is also negotiating with two venture capital funds from Europe and the Gulf, to close a $10 million fund in its seed round by the end of the year.

Doaa Abdel-Hameed, the Chief Business Officer of the company said: “we aim to help restaurants in offering an easier food ordering experience to their customers. Either through food delivery or reserving a table in the restaurant, as well as taking away orders and also the special orders made by customers in their restaurants.”

“We pursue a better experience for the Egyptian user in food ordering. We see a lot of potential and opportunities to do that through developing the App constantly based on the user reviews. And adding more restaurants in all of the Egyptian governorates.” She added.

BONBELL has earned the trust of more than 12,000 customers, who used the app in food ordering in all the ways offered through the App, in just 6 month.

Doaa Abdel-Hameed emphasized that the success of BONBELL App, in offering the best experience to its users can only be done through strategic partnerships with many more restaurants. In addition to the constant development of the technology used in the App, as well as relying on offering inventive solutions to the Egyptian user such as (Robotic Stations) service.

This service will offer customers the experience of food ordering and serving through a Robot, without any human intervention. It is expected to launch in Egypt at the end of 2023.

Investing

Dream VC applications: A peek behind the scenes

Dream VC breaking down the numbers and representation in its programs

A year ago, Dream VC quietly launched its first inaugural cohort applications with the hopes of closing the investing knowledge gap for check-writers and ecosystem builders across the continent. Fast forward one year later, they have received an overwhelming amount of interest from people curious about investing and contributing to the African startup ecosystem. Across two cohorts alone, they have processed more than 2000 applicants from 30 African countries. With fellows dialing in five continents and multiple time zones.

That being said, they’d like to share some interesting findings they have extracted and learned from the whirlwind that Dream VC has been in from last year to now.

Cohorts

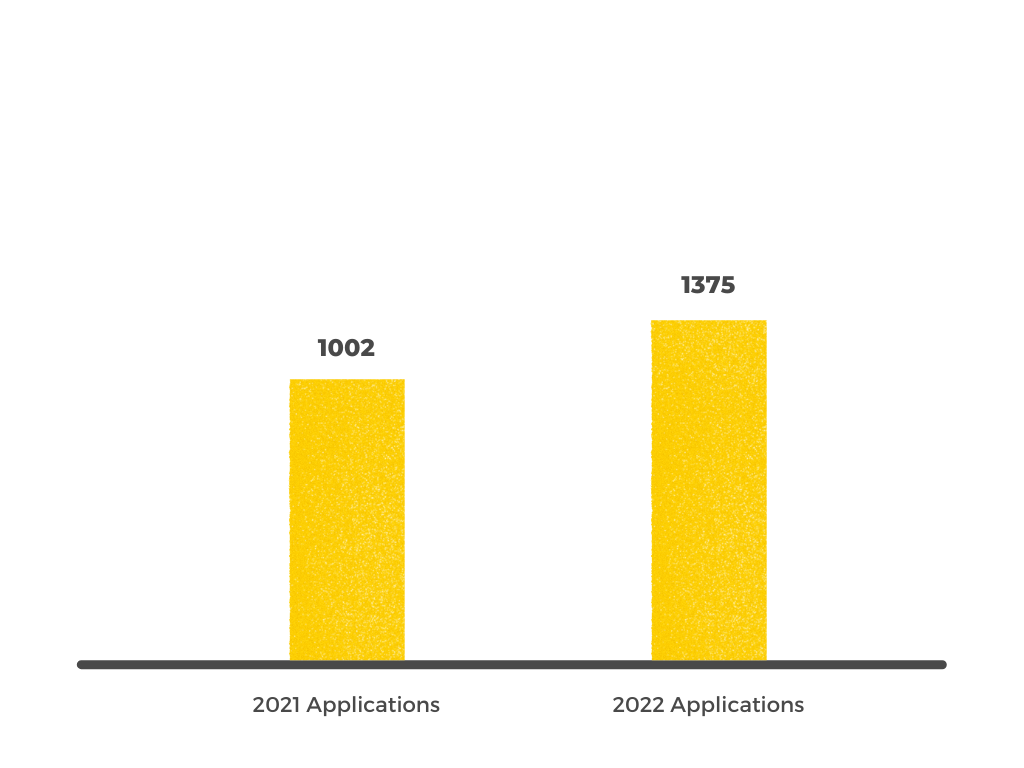

By the end of 2022, Dream VC will have 2 cohorts under its belt with 3 programs run. There has been an increase in total applications despite the difference in price point between the 2021 program and this year.

Breakdown Of The 2021 Cohort

For its inaugural cohort, they received a total of 1002 applications and had an intake of 31 fellows, with an acceptance rate of 3%. The average age of its fellows was 25, with most being in their mid-twenties to late twenties. And exploring VC as a new career pivot after a few years of full-time work experience. After 4 months of rigorous and community-driven engagements, a total of 19 Fellows graduated from the program with an issued certification.

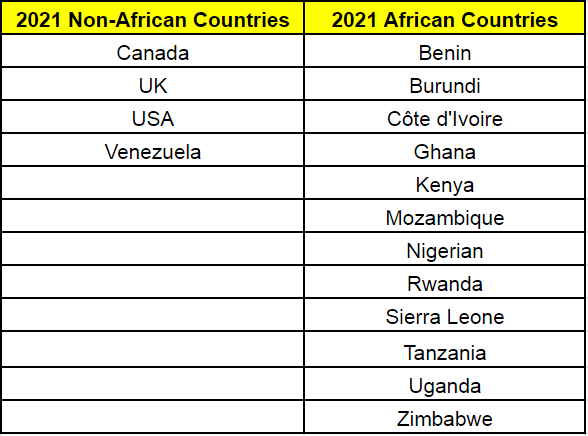

When looking at the specific demographics of Dream VC’s inaugural fellows, findings show that 90% of the fellows were homegrown. Which they classified as having been born, raised, and educated on the continent. They also had 12 African countries represented and 16 different Nationalities in total.

Although its initial intake consisted of 33% women, the final certified graduating fellows consisted of 60% women. Meaning that all of the female fellows who joined the fellowship finished the program.

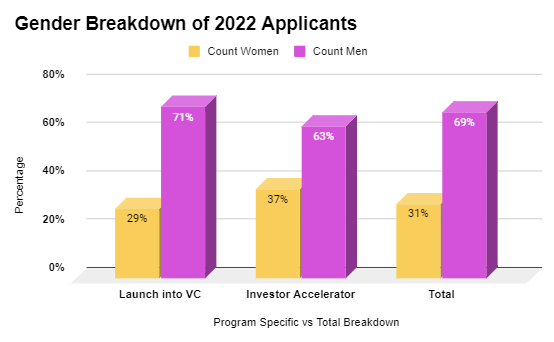

This is a strong indication of the perseverance of its female fellows in particular. And they are committed to making a strong push to convert more women into its talent pipeline. Especially given that only 15% of the 2021 applicants identified as female. At Dream VC, they urge more women to apply for its programs and also reapply for future cohorts if they were not accepted initially.

Breakdown Of The 2022 Application Cycle

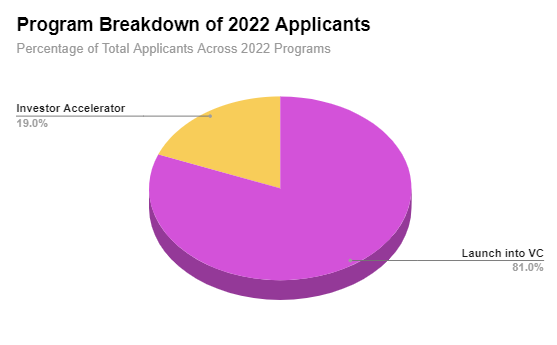

For 2022, Dream VC opened its applications on March 8th and had then remained open for over a month and a half until its final deadline on May 1st. In total, they received a total of 1,375 applications for its Launch into VC (“LIVC”) and Investor Accelerator (“IA”) programs.

Around 81% of the total applications were for our Launch into VC fellowship, and the remaining 19% were for the Investor Accelerator. We received a total number of 1,113 applications for Launch into VC, and 262 for Investor Accelerator.

Gender Breakdown

Out of the total applications for 2022, 31% of the applicants identified as female. When taking a closer look at the gender breakdown for each program, Investor Accelerator had a higher percentage of female applicants with 37% of total Investor Accelerator applicants, while Launch into VC had 29%.

Nationality Breakdown

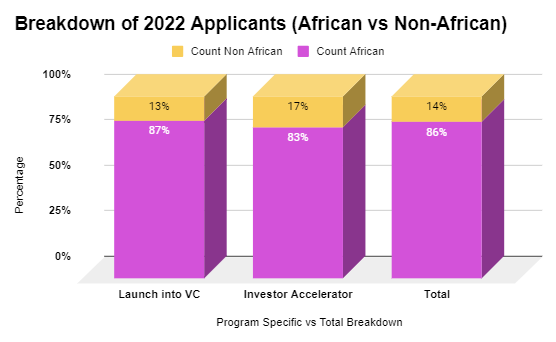

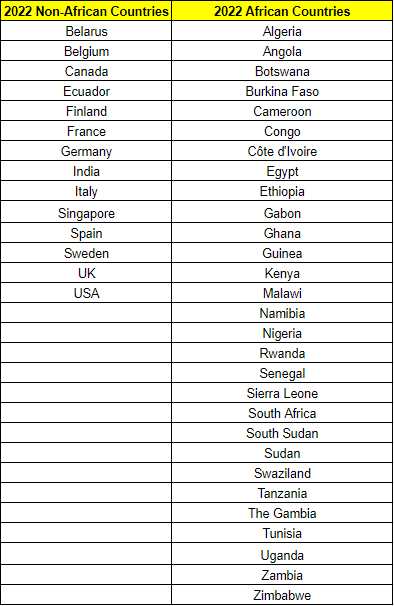

When reviewing the nationalities of the applicants, it was found that for 2022, Dream VC has exponentially expanded its reach of applicants in both nationality and location. However, most of the applicants are still overwhelmingly from the continent and diaspora, which accounts for 86% of the total applicants. The remaining 14% hail from non-African countries such as India, Singapore, and Germany with non-African backgrounds.

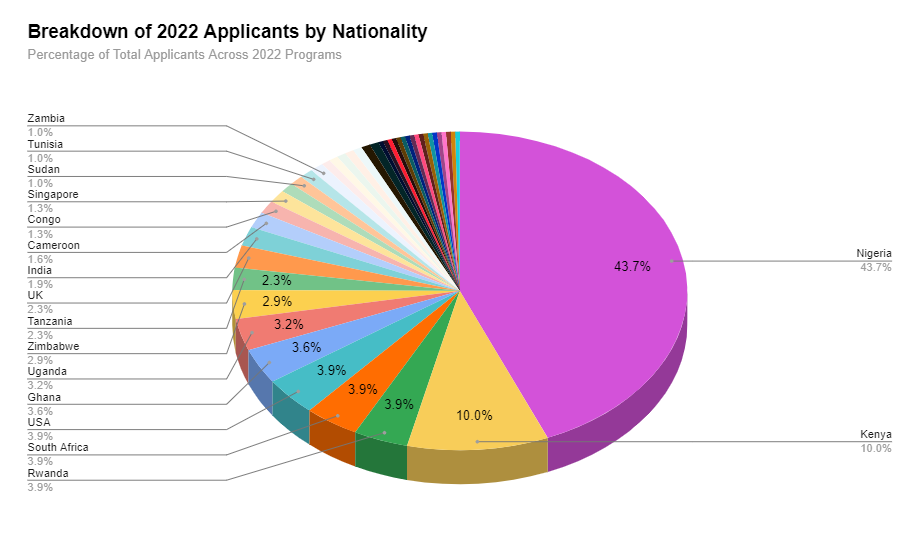

When looking more closely at each program, 87% of the applicants for Launch into VC applicants were homegrown or African diaspora, compared to 83% of the Investor Accelerator applicants. This year saw 30 different African countries across the continent represented. With a majority of the applicants coming from Nigeria (43.7%), followed by Kenya (10%), Rwanda and South Africa (3.9% each respectively), Ghana (3.6%), Uganda (3.2%), Zimbabwe (2.9%), and Tanzania (2.3%).

Interestingly, the country represented the most by the diaspora applicants was Cameroon, followed by Nigeria, across both programs.

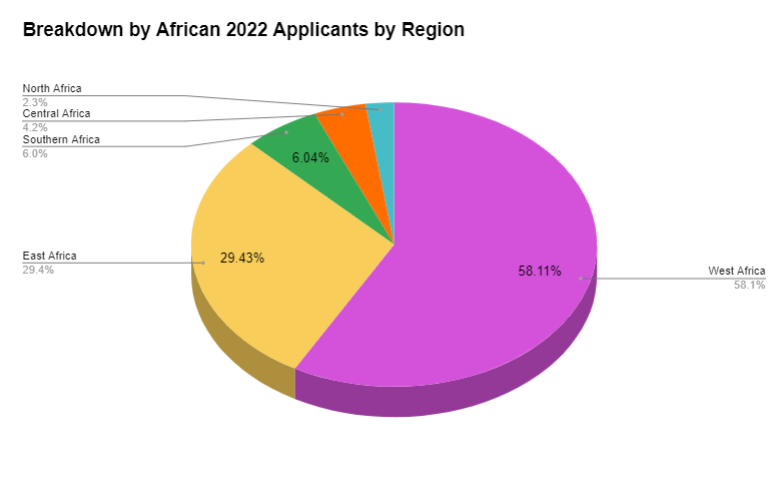

Across the different African regions, West Africa took the lead in applicants with over half of the applicants hailing from the region (58%). East Africa contributed to another quarter with approximately 29% of applicants coming from the area, followed by Southern Africa (6%), Central Africa (4%), and finally North Africa (2%). Dream VC’s footprint can still be solidified further, particularly in the ecosystems in North Africa, and its team will be traveling actively to Egypt, Morocco, and Tunisia to build relationships there.

Locations Breakdown

When looking at the locations of applicants applying from outside the continent (including diaspora and non-Africans), over 50% of them applied from the United States and the United Kingdom. Dream VC also saw an increase of Indian and Singaporean applicants from Asia. And a spread of interesting European countries including Belgium, Belarus, Germany, France, Finland, and Sweden.

Closing Remarks & Reflections

Since launching Dream VC in 2021, the team has been endlessly grateful for the overwhelming interest from the African & International community. As well as the selfless support that has been extended by various ecosystem partners and connections in our network.

Its application cycles have revealed several interesting insights into where the strong interest can be found in various startup ecosystems. As well as certain areas we are endeavoring to have better reach in (ex: North Africa and Arabophone countries).

They also strongly encourage more female applicants to apply AND reapply to its programs. As they are strongly committed to building out the opportunity and talent pipeline for black women in particular focused on investing in Africa.