Investing

Interview: Dream VC Co-Founders On Building the Go-To Launchpad for Aspiring Investors in Africa

Dream VC Co-Founders; Mark Kleyner and Cindy Ai (Image: Dream VC)

Dream VC, a leading Investor Accelerator, returns in force to democratize knowledge and access to the Venture Capital Space in Africa. In this interview, Alaba Ayinuola engages Mark Kleyner a Co-Founder, to learn more about Dream VC, its programs, impact and the gap its filling in the investments ecosystem in Africa. Excerpts.

Alaba: Could you briefly tell us about Dream VC and what is set to achieve?

Mark: Of course. Dream VC is an investor accelerator and community-driven educational platform providing rigorous remote programmes centred specifically around venture capital across Africa’s startup ecosystems. Dream VC actually began as an idea; birthed from countless conversations with ecosystem players across the continent. All ultimately centred around the problem of ‘investor talent pipelines’ and ‘lack of infrastructure’. We realised that there was an opportunity in addressing some of these issues. The core focus right now for what we want to achieve is to provide stronger infrastructure in the Venture Capital Ecosystems across the African continent. Our aim is to increase VC investments in Africa significantly, through our programs and wider initiatives.

Alaba: What is the inspiration behind it and who are its Founders?

Mark: Being an investor in Africa means being in the trenches with entrepreneurs building solutions for hard problems, providing hands-on support and facing local barriers. Aside from this, there are also many cultural nuances to investing across Africa that would normally never be covered in general VC fellowships. Hence the steep learning curve for those unfamiliar with these challenges. Realising that, having worked with a number of startups and Venture Capital firms both on the continent and abroad, with an African focus. Dream VC was created to bridge the access to the necessary knowledge, networks and opportunities for aspiring investors to launch or accelerate their Venture Capital careers.

Dream VC’s founders are Mark Kleyner and Cindy Ai. Having worked with a range of startups through MZZ Africa, advising startups at multiple accelerators like Founder Institute, Seedstars, VillageCapital and others. And from formerly leading the African Rounds of She Loves Tech. The founders are both operators, entrepreneurs and VCs, and have worked in over 15 startup ecosystems across the US, UK, Europe, South East Asia and Western Africa.

Alaba: Who is the Dream VC Ideal Candidate?

Mark: This year Dream VC is launching two large programs, both of which aim to tackle a different issue in the Venture Capital Markets in Africa. First, Launch into Venture Capital (LIVC), a Fundamentals Crash Course to Breaking into Venture Capital for Young Working Professionals. The second, Investor Accelerator (IA), an Intense Fellowship For Seasoned Working Professionals Looking to Pivot into An Investing Career.

Both programs, by nature of their focus, have specific target audiences. LIVC is a better fit for those who want to break into VC. Securing roles as interns, analysts, associates etc at Venture Capital Funds and other entities in the startup x VC ecosystems. IA, on the other hand, targets more seasoned working professionals, who are able to bring a multi-year track record of operator experience. Who may have been successful entrepreneurs or who for instance bring management, leadership or substantial community building experience to the table. While neither program has an age requirement. We believe that the core ‘driving goals’ for individuals who take part in either LIVC or IA are substantially different, and few people could be in the position to fit both.

A core consistency for both programs is that our ideal candidates are individuals who are truly passionate about the African startup ecosystems. Who want to understand Venture Capital because of a longer-term goal in working with/for/within or alongside the African Venture Capital markets.

Alaba: Could you tell us more about the program structure, duration and fees?

Mark: Both of the programs are entirely remote and include substantial live and on-demand content. Dream VC’s Launch into Venture Capital Program is a 14-week program, with Weekly Learning Sessions, Active All-Hands, Socials and Industry Leading Panels. This is complemented by hands-on workshops and weekly assignments throughout the entire program. As well as an extensive in-house database, compiling 500h+ of content. The current program cost is $1,000. Though scholarships and limited bursaries are available for anyone who can demonstrate a clear passion throughout the application process and evidences their need for such support.

Dream VC Fellows with Cindy (Image: Dream VC)

Dream VC’s Investor Accelerator Program is much more in-depth. This is a 20-week program, with more frequent and longer Weekly Learning Sessions, Active All-Hands, Masterclasses and Industry Leading Panels. While the program does not have frequent assignments, learning and implementation is still a core part of the experience. This is why the Investor Accelerator program comes with substantially more panels and industry interaction. The IA program is complemented with dedicated office hours, monthly mock investment committee simulations and a community-driven dealflow pipeline. All participating fellows likewise receive access to a suite of investment research tools and databases. And access to the wider Dream VC in-house database, comprising over 800h+ of content. The current program cost is $5,000.

Alaba: Since you launched in Nigeria, what is the response like?

Mark: Last year, Dream VC went through a quiet launch. As always, our ethos was and remains that we want fellows to action our learning and advice. The core aim of this initial launch was to prove that;

i) There are a lot of individuals who want to work in VC funds across the African markets.

ii) There is a a huge market of individuals who want to start supporting African startups, with funding, expertise, access or more.

iii) That Dream VC can help such individuals to launch their careers to break into VC funds, entrepreneurship support organisations and/or better upskill them on what VC. And how to work with or within the industry.

The response was certainly greater than we could have imagined, especially in Nigeria. In the first program, with applications open for just over a week, Dream VC saw a total of 1000+ applicants submit their interest. Selecting the top 30, after a rigorous three-step-process. These 30 would go on to take part in our highly intensive flagship fellowship, with 97% achieving their goals by program end. Our focus was not exclusively on Nigeria, though a good 10+ of our initial cohort ended up being Nigerian fellows.

Dream VC Fellows with Cindy (Image: Dream VC)

Fellows’ backgrounds varied significantly, but the engagement was fantastic throughout the program. This is best evidenced by their enthusiasm for fellow meet-ups and their success at a post program level. Now, 5 months after the 2021 program ended, multiple graduates have gone on to join African focused investment firms like LoftyInc, Oui Capital, Ajim Capital, Akribos Capital, Lateral Capital, Counder and more. Others, among our fellows, have now started new Angel Networks and made first investments in countries like Nigeria, Mozambique, Côte d’Ivoire.

There are more examples, but overall we were very happy with the high reception in 2021. And realised that we must do more to address the substantial demand for understanding the VC space, from working professionals on the continent and among the diaspora. That is why, for 2022, we substantially expanded our capacity to deliver content, improved the breadth of our material and are launching two substantially larger programs. Both of which promise to bring more to fellows than our flagship 2021 program.

Alaba: How does your organisation measure impact?

Mark: For Dream VC “impact” is both direct and indirect. Directly, we measure impact throughout the program on the lives of our fellows and their activities more widely. Out of the program graduates, 97% have stated that they achieved their program goals. Fellows have gone on to join more than 8 different VC funds and multiple other firms in the innovation economy. More widely, we aim to track our success on an ecosystem level.

While Dream VC’s programs are exclusive and only accept dozens of fellows for each program, these fellows go on to build incubators, accelerators, launch syndicates, create funds or start startups in their own right. These have already gone on to directly impact or fund 50+ different companies. We anticipate long term, this will have a more substantial effect on the ecosystem at large.

Alaba: What is your view on Africa’s investing ecosystem?

Mark: I am incredibly bullish on the future of all 54 markets across the African continent. The investment ecosystem is still very young and substantially has not capitalised on the immense potential of the alternative asset classes. While there are several stock exchanges, and these have been evolving over time, the private capital space is still barely scraping its long term potential. While the amount of Venture Capital funding for African startups has grown, from its initial $30-50m back in 2012-13, through to more than $5.2bn as of 2021, this is really just the beginning.

Firstly, most of this $5.2 is highly concentrated, going towards just a small number of companies, with 21 deals driving almost $3bn out of this $5.2bn. Secondly, the investment world is much more substantial than just the VC space. Beyond Venture Capital investments, the private equity space is also growing. We are seeing strong growth across real estate markets and even public equities.

Furthermore, most of the current investment in the startup ecosystem is not actually tapping into domestic wealth and is coming from international funders, international funds and global VCs. What this means, is that in the event of a high-value fundraise, where the startup yields a great return for their investors. That money will often leave the African startup markets, travelling back to Limited Partners (those providing money to the investment funds themselves). Most of who are based in the UK, in France, in the US or in China and realistically that cannot be the ‘majority case’. Both among the wealthy elite, and more widely among working professionals, angel investors and individual funders. Their investments into startups or into VC funds pale, compared to those going towards the property market, family businesses, land, agriculture and more traditional investments.

My belief is that most value for this next generation will be created in the private market space. By the thousands of new companies that were formed last year, that will be formed this year and that will be formed in years to come. Who will hopefully raise billions of dollars in funding and truly re-define the private markets across Africa. We’re excited to be part of this process, and see our core role as enabling this transition to happen. By activating all different stakeholders in making the VC markets more transparent. Enabling individuals to get involved and building the ecosystem they need to do that.

Alaba: Where do you see Dream VC in the next 5 years?

Mark: The Venture Capital and startup ecosystems are evolving as we speak across the African markets and I see Dream VC being a core part of that process. We’ve started with some really difficult issues. They aren’t “sexy” to solve, but talent in the VC space and access to the investment side are just the start of where we see ourselves going in Venture Capital. We have an extensive roadmap and we’re already working with partners in multiple ecosystems on future programs and future pain points we wish to address. At the moment it’s difficult to break into VC, it’s difficult to understand what VC is, it’s hard to be promoted in the space. Both domestic and international funds face loads of challenges too.

Beyond that, most startups don’t know enough about the VC sector to succeed. And, as we see the space evolve, there’s a major deficit of talent in other areas of VC that we wish to address. I see us addressing these and taking the first steps to providing solutions to a number of those challenges in the next 2-3 years. In the next 5 years, I want to see Dream VC become an established name. A “go-to” for anyone wishing to learn more, break into or engage with the Venture Capital markets in Africa.

Investing

Goodwell Investments leads USD 8.5 million Series B round for Good Nature Agro

Impact investor Goodwell Investments has joined forces with social impact investing cooperative Oikocredit and Global Partnerships/Eleos Social Venture Fund (GP SVF) to provide USD 8.5 million in equity to Zambian social enterprise Good Nature Agro (GNA).

Good Nature Agro currently supports about 30,000 southern African smallholder farmers in growing drought-resistant, early-maturing legume seed varieties, including beans, cowpeas, soyabeans and groundnuts. Its agritech-based business model encompasses access to inputs, input finance, smart and reduced fertiliser use, climate-smart training, and a guaranteed market for high-value produce, giving farmers a wealth of support to professionalise their businesses and establish a clear path out of poverty.

In line with Goodwell’s mission to support innovative African companies that are contributing to a more inclusive society, the organisation first invested in Good Nature Agro in 2020 via its uMunthu I fund. In the years since, GNA has continued to expand its ambitions and reach, consistently growing farmers’ productivity and incomes, as well as improving their access to finance. In addition, the company has recently opened a new factory in Lukasa.

To enable GNA’s next phase of growth, Goodwell Investments led the company’s series B round, partnering with Oikocredit and GP SVF to raise a total of USD 8.5 million. With this new investor capital, GNA aims to grow its client base to 50,000 farmers by 2027. It will also deepen its engagement with its clients, improve its integration of whole farm income, develop new genetics to deliver greater yields and resilience, and innovate to keep its clients at the centre of agricultural supply chains.

Neo Maruatona Ratau, the Investment Director at Goodwell Investments, eagerly anticipates GNA’s future accomplishments, stating, “The remarkable growth GNA has experienced since our initial investment has been impressive. We have observed the company’s ability to deliver robust financial returns and make a significant social impact, all thanks to its farmer-centric business model, which effectively integrates smallholder farmers into the agricultural value chain. We are delighted to collaborate with investors Oikocredit and Global Partnerships to support GNA’s upcoming growth phase, which will be fueled by the convergence of digital and financial inclusion, along with strategic inorganic growth initiatives.”

Samuel Kibiri, Oikocredit’s Equity Officer for Africa, is equally enthusiastic about GNA’s potential for creating impact, saying, “Our new partnership with Good Nature Agro will enable Oikocredit to help more low-income African farmers improve their livelihoods through improved yields and access to markets. We’re delighted to be co-investing with like-minded investors in an innovative business with a clear mission to move farmers out of poverty.”

Finally, Jim Villanueva, Managing Director of GP SVF at Global Partnerships, is confident in GNA’s ability to continue to deliver remarkable results, saying, “We first invested in GNA during their seed round in 2018 and have witnessed the enterprise’s ability to adapt and scale its offering to enable farmers to increase and diversify their incomes, in the face of both climate change and gender inequality. We are proud of the results achieved to date and the opportunity to support GNA in this next chapter of growth and impact.”

Reflecting on the new investment, Carl Jensen, CEO of Good Nature Agro comments, “Good Nature has broken the boundaries of most agribusinesses by engaging the full value chain – connecting growers, aggregators, processors and consumers – and delivering exceptional service through a hybrid tech and ‘boots on the ground’ model. We very much welcome Oikocredit as a new investor, endorsing our approach and potential, and are equally grateful for the partnership and trust of our existing investors Goodwell and GP SVF who participated in this round.”

Investing

Egypt’s BONBELL seeks $10 million seed funding after closing $350,000 initial round

Egypt’s startup BONBELL, the first mobile App in the Food-tech industry specialized in food ordering, digital solutions for table and meal reservations, has closed an initial funding round for $350,000. This is through a Canadian Angel investor, to help further develop the App services and achieve a level of growth in regard to user count and daily orders.

BONBELL launched its own App in early 2022, to offer a wide range of food ordering services in Egypt. The App offers many food ordering solutions, from food delivery to restaurant’s reservations and Dine-in ordering through a QR Code on the tables, as well as take away services. The App offers various payment solutions through cash or credit cards.

BONBELL has partnered with many restaurants and cafes, as well as clubs like Heliopolis Club and Smash Club. It also offers its services in Malls and Cinemas, to offer a smoother food ordering experience, reserving tables and food delivery, for mall and cinema goers. It has also strategically partnered with many leading major companies and institutions. Most notably the German University in Cairo (GUC), and Raya Telecom, in order to offer its services in their respective headquarters for employees and visitors alike.

The Food-Tech startup targets raising its partnered restaurants to 750 by the end of 2022. The company is also negotiating with two venture capital funds from Europe and the Gulf, to close a $10 million fund in its seed round by the end of the year.

Doaa Abdel-Hameed, the Chief Business Officer of the company said: “we aim to help restaurants in offering an easier food ordering experience to their customers. Either through food delivery or reserving a table in the restaurant, as well as taking away orders and also the special orders made by customers in their restaurants.”

“We pursue a better experience for the Egyptian user in food ordering. We see a lot of potential and opportunities to do that through developing the App constantly based on the user reviews. And adding more restaurants in all of the Egyptian governorates.” She added.

BONBELL has earned the trust of more than 12,000 customers, who used the app in food ordering in all the ways offered through the App, in just 6 month.

Doaa Abdel-Hameed emphasized that the success of BONBELL App, in offering the best experience to its users can only be done through strategic partnerships with many more restaurants. In addition to the constant development of the technology used in the App, as well as relying on offering inventive solutions to the Egyptian user such as (Robotic Stations) service.

This service will offer customers the experience of food ordering and serving through a Robot, without any human intervention. It is expected to launch in Egypt at the end of 2023.

Investing

Dream VC applications: A peek behind the scenes

Dream VC breaking down the numbers and representation in its programs

A year ago, Dream VC quietly launched its first inaugural cohort applications with the hopes of closing the investing knowledge gap for check-writers and ecosystem builders across the continent. Fast forward one year later, they have received an overwhelming amount of interest from people curious about investing and contributing to the African startup ecosystem. Across two cohorts alone, they have processed more than 2000 applicants from 30 African countries. With fellows dialing in five continents and multiple time zones.

That being said, they’d like to share some interesting findings they have extracted and learned from the whirlwind that Dream VC has been in from last year to now.

Cohorts

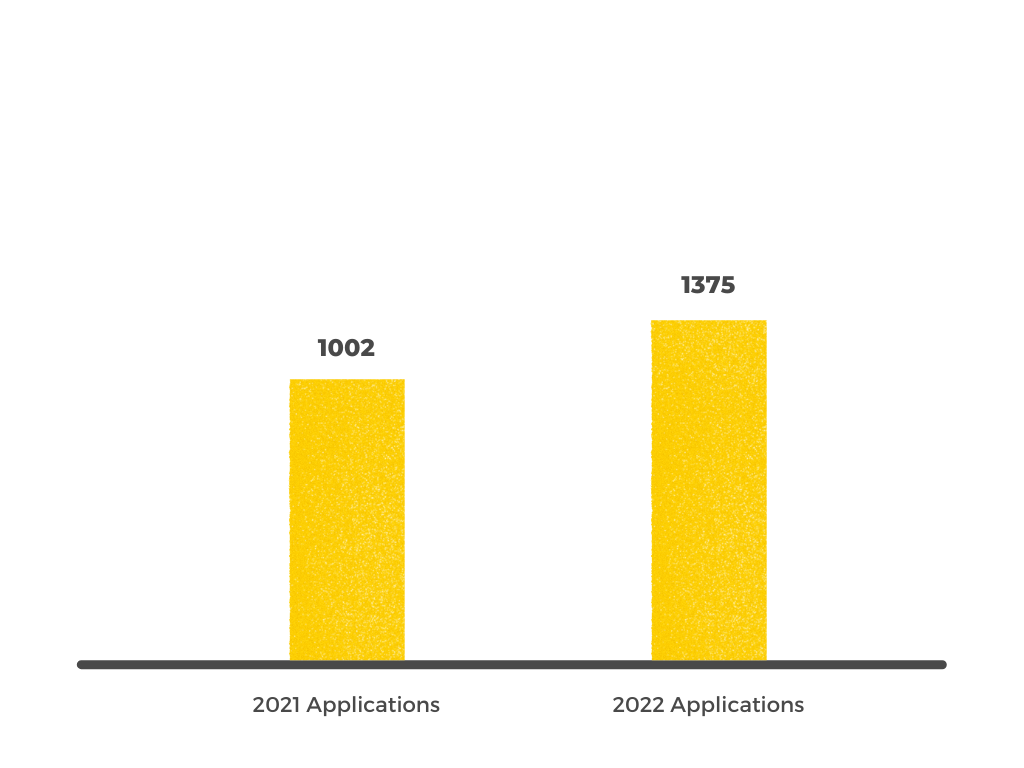

By the end of 2022, Dream VC will have 2 cohorts under its belt with 3 programs run. There has been an increase in total applications despite the difference in price point between the 2021 program and this year.

Breakdown Of The 2021 Cohort

For its inaugural cohort, they received a total of 1002 applications and had an intake of 31 fellows, with an acceptance rate of 3%. The average age of its fellows was 25, with most being in their mid-twenties to late twenties. And exploring VC as a new career pivot after a few years of full-time work experience. After 4 months of rigorous and community-driven engagements, a total of 19 Fellows graduated from the program with an issued certification.

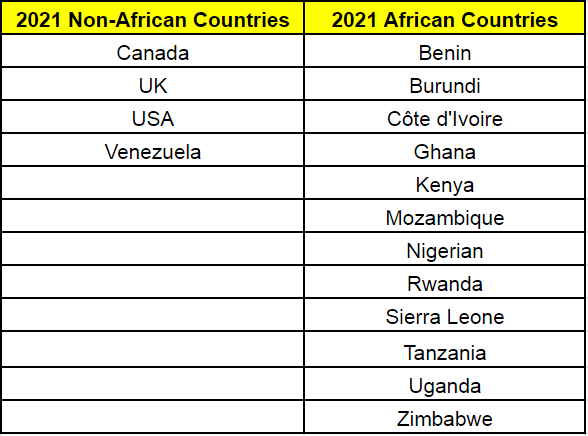

When looking at the specific demographics of Dream VC’s inaugural fellows, findings show that 90% of the fellows were homegrown. Which they classified as having been born, raised, and educated on the continent. They also had 12 African countries represented and 16 different Nationalities in total.

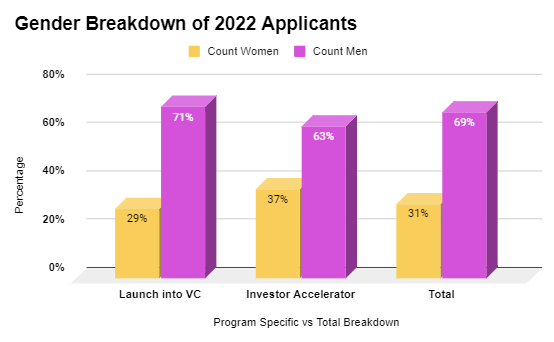

Although its initial intake consisted of 33% women, the final certified graduating fellows consisted of 60% women. Meaning that all of the female fellows who joined the fellowship finished the program.

This is a strong indication of the perseverance of its female fellows in particular. And they are committed to making a strong push to convert more women into its talent pipeline. Especially given that only 15% of the 2021 applicants identified as female. At Dream VC, they urge more women to apply for its programs and also reapply for future cohorts if they were not accepted initially.

Breakdown Of The 2022 Application Cycle

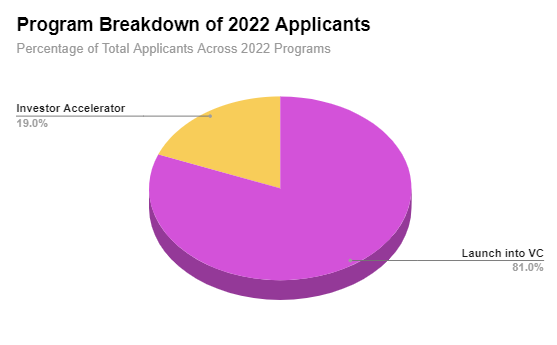

For 2022, Dream VC opened its applications on March 8th and had then remained open for over a month and a half until its final deadline on May 1st. In total, they received a total of 1,375 applications for its Launch into VC (“LIVC”) and Investor Accelerator (“IA”) programs.

Around 81% of the total applications were for our Launch into VC fellowship, and the remaining 19% were for the Investor Accelerator. We received a total number of 1,113 applications for Launch into VC, and 262 for Investor Accelerator.

Gender Breakdown

Out of the total applications for 2022, 31% of the applicants identified as female. When taking a closer look at the gender breakdown for each program, Investor Accelerator had a higher percentage of female applicants with 37% of total Investor Accelerator applicants, while Launch into VC had 29%.

Nationality Breakdown

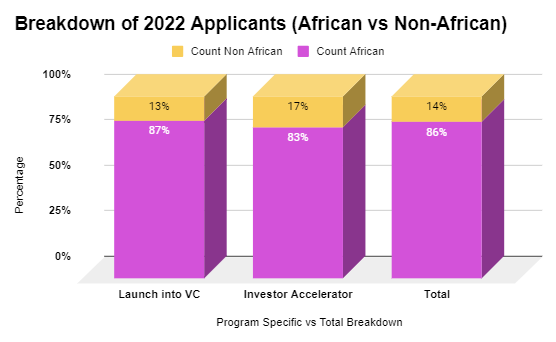

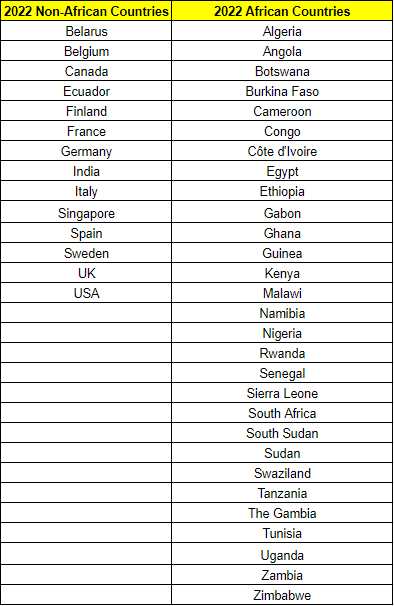

When reviewing the nationalities of the applicants, it was found that for 2022, Dream VC has exponentially expanded its reach of applicants in both nationality and location. However, most of the applicants are still overwhelmingly from the continent and diaspora, which accounts for 86% of the total applicants. The remaining 14% hail from non-African countries such as India, Singapore, and Germany with non-African backgrounds.

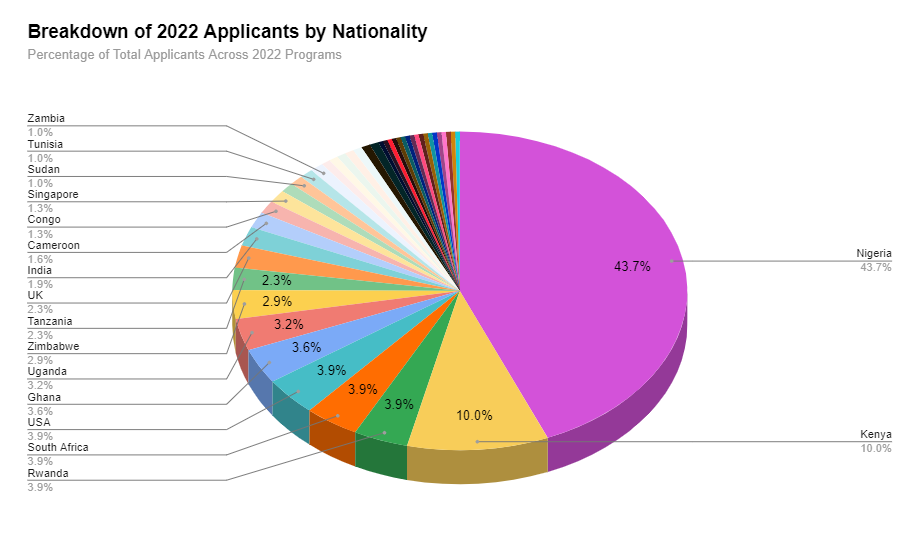

When looking more closely at each program, 87% of the applicants for Launch into VC applicants were homegrown or African diaspora, compared to 83% of the Investor Accelerator applicants. This year saw 30 different African countries across the continent represented. With a majority of the applicants coming from Nigeria (43.7%), followed by Kenya (10%), Rwanda and South Africa (3.9% each respectively), Ghana (3.6%), Uganda (3.2%), Zimbabwe (2.9%), and Tanzania (2.3%).

Interestingly, the country represented the most by the diaspora applicants was Cameroon, followed by Nigeria, across both programs.

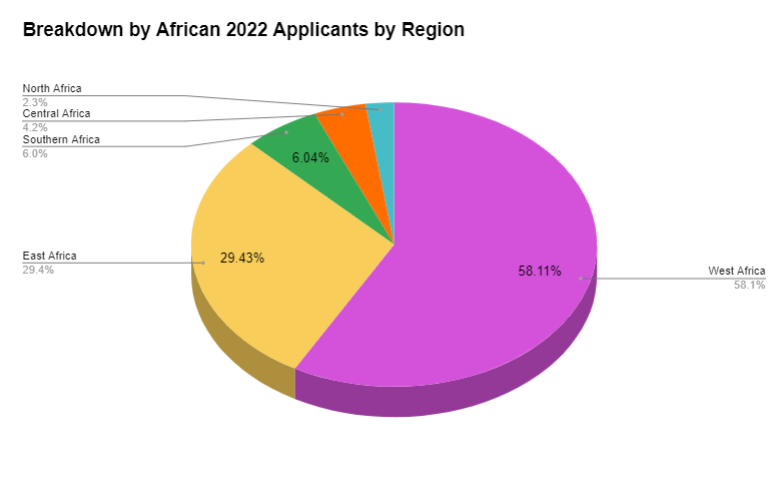

Across the different African regions, West Africa took the lead in applicants with over half of the applicants hailing from the region (58%). East Africa contributed to another quarter with approximately 29% of applicants coming from the area, followed by Southern Africa (6%), Central Africa (4%), and finally North Africa (2%). Dream VC’s footprint can still be solidified further, particularly in the ecosystems in North Africa, and its team will be traveling actively to Egypt, Morocco, and Tunisia to build relationships there.

Locations Breakdown

When looking at the locations of applicants applying from outside the continent (including diaspora and non-Africans), over 50% of them applied from the United States and the United Kingdom. Dream VC also saw an increase of Indian and Singaporean applicants from Asia. And a spread of interesting European countries including Belgium, Belarus, Germany, France, Finland, and Sweden.

Closing Remarks & Reflections

Since launching Dream VC in 2021, the team has been endlessly grateful for the overwhelming interest from the African & International community. As well as the selfless support that has been extended by various ecosystem partners and connections in our network.

Its application cycles have revealed several interesting insights into where the strong interest can be found in various startup ecosystems. As well as certain areas we are endeavoring to have better reach in (ex: North Africa and Arabophone countries).

They also strongly encourage more female applicants to apply AND reapply to its programs. As they are strongly committed to building out the opportunity and talent pipeline for black women in particular focused on investing in Africa.

-

Afripreneur2 days ago

Afripreneur2 days agoMeet Datari Ladejo, the digital strategist helping brands thrive in the digital economy

-

Afripreneur8 hours ago

Afripreneur8 hours agoCreativity, Data, and Innovation: Tutu Adetunmbi’s Vision for Africa’s Marketing Future with Stamfordham

-

Press Release1 day ago

Press Release1 day agoThe 234 Venture Vault Launches Tech Startups and Talents Hunt Across Nigerian Tertiary Institutions

-

Afripreneur7 hours ago

Afripreneur7 hours agoMeet Nzinga B. Mboup, a Senegalese architect committed to climate-friendly construction for African cities