Economy

The Implication Of Financial Illiteracy In Nigeria

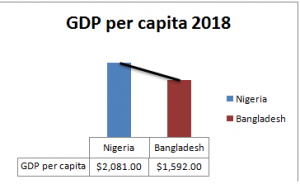

Nigeria is a country with a high Gross Domestic Product (GDP) compared to its colleague in the developing yard Bangladesh. Data revealed that with the high GDP, Nigeria harbors 4-time people living below the poverty line than Bangladesh. The reasons can be attributed to the country’s 56 percent income spend on food (highest in the world) as opposed to its counterpart with less than 40 percent. In Nigeria, approximately 60 percent live below the poverty line. In Bangladesh, however, that number is 24.3 percent indicating 55.3 percent likelihood to live below the poverty line in Nigeria compared to Bangladesh.

Source: Country Economy, 2018

Should appropriate financial knowledge (Literacy) solve this discrepancy considering:

- The current situation of education curriculum containing only 5% of studied courses about personal finance for non-business students and only 10% studied financial courses in business colleges.

- The literacy rate. In Nigeria, the literacy rate is 59.6%. In Bangladesh, it is 72.8% showing a 22.1 percent more likely to be literate in Bangladesh when compared to Nigeria.

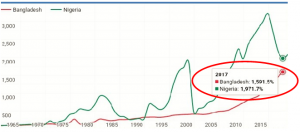

- The Gross Domestic Product (GDP) of the two economies as shown in the figure below;

Source: Country Economy, 2018

Asides the high GDP in Nigeria compared to Bangladesh, above all others metric, Bangladesh is a better economy owning to Nigeria’s low level of Education and epileptic education structure; education which can increase the level of financial literacy is in shambles. It becomes imperative for the government of the country to devise actionable plans to improve its citizen’s financial literacy which will invariably repress consumption, at the same time, encourage saving and investment. This is based on the assumption that negative relationship exists between literacy level and consumption. In other words, the higher the financial literacy, the more informed the citizens financial decisions are, hence a moderate consumption. As such, it will be concluded upon that high level of is associated with low consumption level. More so, in a study conducted by Adriaan K. et al (2016)[i] to examine the impact of financial literacy on household consumption. It was found that financial literacy of man plays a large role and a higher financial literacy score of the women decreases consumption.

What is Financial Literacy

In simple terms, it is a skill that helps people to make financial decisions effectively. It ensures having the required and appropriate knowledge, skills, and confidence to make responsible financial decisions. Research has found a positive relationship between financial literacy and financial decisions. Putting that into context, a high level of financial literacy translates better financial decisions and its low level equate poor financial decisions in which the latter is attributable to the current situation of the giant of Africa.

Contextually, the position of literature on elucidating a better understanding of financial literacy defines “knowledge as an understanding of personal and broader financial matters; skills as the ability to apply that financial knowledge in everyday life; confidence as having the self-assurance to make important decisions and responsible financial decisions as to the ability of individuals to use the knowledge, skills, and confidence they have gained to make choices appropriate to their own circumstances”. It gives the twin benefit of protecting from financial frauds as well as planning for financially secured future.

A poor or low financial literacy is often influenced by family background as found by Lusardi(2008) who claimed that 41 percent of required knowledge for better financial decisions usually comes from parenting and home advice. As such, family wealth accumulation lined in the league of factors affecting individual financial decisions. Others factors attributed to poor financial decisions include Education, household income, financial responsibility, and place of residence. The low level of financial literacy has affected and can be attributed to the slow pace with which Nigerians have adopted financial services in rural and urban areas.

Whose Responsibility?

The APEX Bank of Nigeria, Central Bank of Nigeria (The Bank), has released as part of its mandate to improve the level of financial literacy in the country. The bank in a statement stated that:

“An important mandate of the Bank is the promotion of a sound financial system in Nigeria. A key aspect of this function is the entrenchment of effective consumer protection regime that not only protects the rights of consumers but also engenders public confidence in the financial system. Furthermore, the bank added a commitment in 2011 referred to as the MAYA DECLARATION, to reduce the number of financially excluded Nigerians from 46.3 percent in 2010 to 20 percent by the year 2020”.

The current exclusion rate in 2018 was about 36.8 percent according to a recent report by Enhancing Financial Innovation and Access (EfinA, 2018). To ensure the fulfillment of this obligation.

A National Financial Inclusion Strategy was accordingly developed and launched on October 23, 2012. The strategy identified consumer protection and its constituent pillars of Market Conduct, Dispute Resolution & Consumer Education as critical to the attainment of its objectives.

Understanding the position of the bank, the metric for financial literacy is financial inclusion. It was claimed that 68.2 percent of the population is financially included of which 56 percent of income is spent on consumption. Should a high level of financial literacy not better position saving or investment ahead of consumption?

What is my Position?

The dominance of financial mistakes will not come as a surprise; this is due to the relative inadequate financial knowledge among households. High level of financial literacy is what differentiates the two countries mentioned earlier. As long as a larger portion of income is spent on consumption, the poor will remain poor.

As such, Quality Education in all sectors of the economy becomes imperative which includes

- Review of Education Curriculum to include 30 percent of financial related knowledge.

- Provision of incentives to promote savings and investments through financial institutions.

- Public sensitization and awareness on the need for better financial decisions through instilled financial knowledge which could involve partnership with media houses and agencies.

In all, a conscious effort must be made to scale financial inclusion in the country, through financial literacy. An increased level and quality of education can enhance better financial literacy.

Worth noting in a country with a high level of illiteracy is that financial knowledge will be abysmally low and higher proportion of the income will be spent on consumption

This poor knowledge will lead to low savings and investment and the cycle of poverty ensues. The implication of illiteracy can never be overemphasized on nation’s economy.

[i]Milena Dinkova, AdriaanKalwij, & Rob Alssie (2016), The impact of financial literacy on household consumption

Credit: Taiwo Oyekanmi

Economy

Tosin Eniolorunda: Fighting fraud related issues in financial ecosystem requires collaboration

Nigeria’s financial system has come under renewed scrutiny against the backdrop of the increase in the value of electronic payment transactions in Q1 2023 and the challenges posed by bad faith actors who exploit gaps in the payment systems even as Nigerian financial institutions have reported ₦159 billion ($201.5 million) lost to fraud since 2020. There is a need for all players in the financial services sector to come together in tackling these challenges.

Group CEO, Moniepoint Inc., Tosin Eniolorunda during a courtesy visit to the Chief Executive Officer, Fidelity Bank, Nneka Onyeali-Ikpe in Lagos. Onyeali-Ikpe, who welcomed the Moniepoint boss, used the opportunity to reaffirm her bank’s appreciation for the patience and understanding demonstrated during its banking channel integration optimization which resulted in service disruptions and the inability of Moniepoint customers to receive financial inflow.

It will be recalled that Fidelity Bank had recently announced to its customers and the general public, the resumption of interbank transfers to all licensed financial institutions in the country. This was following speculative reports from various media publications that the bank had imposed transaction restrictions on some neo banks operating in the country.

During conversations around the growth of the digital payments segment and contributions of the financial services to Nigeria’s socio-economic development, Tosin Eniolorunda used the occasion to stress the point that Moniepoint as a responsible and compliant organization takes customer KYC very seriously. “KYC is not merely an acronym but indeed a cornerstone in establishing trust, ensuring security, and complying with regulatory standards. All accounts created on our platform have BVN verification and in addition to this we perform a liveliness check at the point of onboarding. This is a comparison of the account holder’s life picture and the BVN image as a way to reduce impersonation,” Eniolorunda maintained.

He continued, “we have zero tolerance for fraud and typically go all out to ensure that we track fraudsters and fraudulent transactions on our platforms. We have deployed and utilize robust fraud detection systems and technologies that can analyze patterns, identify anomalies, and detect suspicious activities in the system. As such we are better empowered to identify potential fraud incidents and trigger alerts for further investigations and remedial actions.”

As partners in deepening the CBN’s mandate of ensuring provision of adequate and convenient financial services to consumers and guaranteeing their protection as well as the various undercurrents in the financial services industry, Moniepoint and Fidelity agreed to work closely together to develop a tightly knit mechanism to stem the menace of fraudulent transactions and collaboratively push through in addressing payment challenges in the country.

Economy

Angola becomes ATI’s 21st Member State, pays USD25m in capital subscription fees

The Republic of Angola has become the 21st African Member State and the 1st Lusophone Member State of pan-African insurer, Africa Trade Insurance Agency – ATI, after paying a capital subscription of USD25 million. The membership was funded the Angolan National Treasury resources and proceeds from the landmark BITA water project – a strategic public investment for the construction of infrastructure for the treatment, supply and storage of drinking water that will benefit 2.5 million people in Angola.

Welcoming Angola’s membership, ATI’s Chief Executive Officer, Manuel Moses, noted the country’s demonstration of its commitment to diversify its economy through ATI’s trade and investment risk mitigation solutions.

“We are happy to support Angola in its quest to economic diversification and becoming an agricultural powerhouse on the African continent. Angola’s membership is timely as ATI’s risk mitigation and credit enhancement services will act as a catalyst for strengthening and diversifying Angola’s economy, supporting both increased investment, exports and trade under Africa’s continental framework of the AfCFTA,” Mr. Manuel said.

Under this one of a kind blended finance and guarantee innovative structure, the Republic of Angola – along with the lenders covered by ATI under the transaction – agreed for the use of proceeds under the syndicated loan to also include the financing for the purpose of Angola becoming a member of ATI. ATI provided guarantee and insurance support for this World Bank’s partially guaranteed facility to the Government of Angola for the expansion and improvement of water supply service in the urban and peri-urban belts of Luanda.

Current exposure

ATI’s gross exposure in Angola, the largest country in Southern Africa Region, currently stands at USD467M mainly in construction, energy & gas, trade & transport, water supply and wholesale & retail sectors, with transactions valued at USD1.4B.

“This development was made possible because of ATI’s pan African mandate that allows the organization to cover transactions in Angola and beyond, despite ATI non-membership. Now that Angola is a fully-fledged shareholder of ATI, the country can fully access more of ATI’s guarantee solutions to attract more Foreign Direct Investments and boost its internal and external trade across the region,” Mr. Manual explained.

Angola’s economy is mainly driven by its oil sector but the country seeks to pursue new growth models for economic diversification through the agricultural sector and private sector development.

With ATI’s support, Angola is on the path to fiscal consolidation, manage their debt ceiling, increase in public and private investment, in order to resume the ascending curve of sustainable and inclusive economic growth as well as human development.

ATI has grown from a small African start-up in 2001 into a pan-African institution with presence across Africa and with a significant global reach. Besides Angola, other member countries include Benin, Burundi, Cameroon, Côte d’Ivoire, Democratic Republic of Congo, Ethiopia, Ghana, Kenya, Madagascar, Malawi, Niger, Nigeria, Rwanda, Senegal, South Sudan, Tanzania, Togo, Uganda, Zambia, and Zimbabwe.

Institutional members include African Development Bank, African Reinsurance Corporation, Atradius Group, Chubb, CESCE (Spanish ECA), Ministry of Finance India (represented by ECGC), SACE SIMEST, The Common Market of Eastern and Southern Africa (COMESA), Trade and Development Bank (TDB), Kenya-Re, The PTA Reinsurance Company (Zep-Re), and the UK Export Finance.

Economy

The Impact on G7’s multi-billion dollar plan on Africa’s infrastructure gap

G7 Members (Photo: European Union)

In late June 2022, it was announced at the G7 Summit in Germany that a USD 600 billion lending initiative, the Partnership for Global Infrastructure Initiative (PGII), would be launched to fund infrastructure projects in the developing world, with a particular focus on Africa. The G7 countries – Canada, France, Germany, Italy, Japan, the United Kingdom (UK) and the United States (US) – explained the PGII would help address the infrastructure gap in developing countries.

The US

The US has recently renewed its focus on impact-building and financing strategic, long-term infrastructure projects in Africa, with the Export-Import Bank of the United States (EXIM) supporting infrastructure development on the continent. According to a 2020 report by McKinsey and Company – Solving Africa’s infrastructure paradox – the US accounts for 38% of global investors who have an appetite for African investment, by far the most of any country. In 2021, the US launched a refreshed “Prosper Africa initiative”, focusing on improving reciprocal trade and investments that create jobs and build infrastructure between the two regions. In 2022, the US announced it would mobilise USD 200 billion over the next five years as part of the PGII, in the form of grants, financing and private sector investments. Some deals have already been announced, including, for example, a USD 2 billion solar energy project in Angola, and the building of multiple hospitals in Côte d’Ivoire.

The EU

In February 2022, the European Commission announced investment funding for Africa worth EUR 150 billion. The funding package is part of the EU Global Gateway Investment Scheme and is said to be in the form of EU combined member funds, member state investments and capital from investment banks.

In early 2020, the European Commission published its Comprehensive Strategy with Africa, outlining the region’s plans for its new, stronger relationship with the continent. The strategy document laid out five top priorities for the EU in Africa: the green transition and improving access to energy; digital transformation; sustainable growth and jobs; peace and governance; and migration and mobility.

The UK

The UK is also making a strong play for influence, investment and trade with Africa, post-Brexit. Further to key summits in 2020 and 2021, finance is being redirected into Africa from the UK. In 2022, UK development finance institution (DFI), British International Investment (formerly CDC Group), announced it had exceeded its pledge to invest GBP 2 billion in Africa over the last two years. The UK’s Global Infrastructure Programme helps partner countries (including in the African continent) to build capacity to develop major infrastructure projects, setting up infrastructure projects for success and paving the way for UK companies to support these projects.

Further, in November 2021, it was announced that the governments of South Africa, France, Germany, the United Kingdom and the United States of America, along with the European Union, were in negotiations to form a long-term Just Energy Transition Partnership. The partnership focuses on boosting the decarbonisation of the South African economy, with a commitment of USD 8.5 billion for first round financing. It is expected that 1-1.5 gigatonnes of emissions will be prevented over the next 20 years, assisting South Africa to accelerate its just transition. Discussions are also currently taking place to establish a similar partnership in Senegal.

African solutions

The African Development Bank noted in early 2022 that Africa’s infrastructure investment gap is estimated at more than USD 100 billion per year.

DFIs are increasingly anchoring the infrastructure ecosystem in Africa – serving a critical function for project finance as investment facilitator and a check on capital. DFIs can shoulder political risk and access government protections in a way that others cannot, enter markets others cannot and are uniquely capable of facilitating long-term lending. The large amount of capital needed to fill the infrastructure gap, however, means that DFIs cannot bridge it alone. Private equity, local and regional banks, debt finance and specialist infrastructure funds are primed to enter the market, and multi-finance and blended solutions are expected to grow in popularity as a way to de-risk deals.

The African Union’s 55 member states have stated that their primary funding needs include support in terms of safety and security on the continent, as well help in implementing the African Continental Free Trade Agreement (AfCFTA) and the massive infrastructure investment it needs to be successful. The development of supporting infrastructure is key to boosting AfCFTA’s free trade potential, especially in terms of transportation, energy provision, internet access and data services, education and healthcare infrastructure projects.

Infrastructure projects in Africa now also have a heightened focus on improving Africa’s capacity for green, low-carbon and sustainable development, via, for example, clean energy, community healthcare and support, green transport, sustainable water, wildlife protection and low-carbon development projects. Funding such projects comes with responsibility – projects must not only be bankable and yield attractive returns, but must also be sustainable and provide tangible benefits to local economies and communities. All of Africa’s major partners have noted they will prioritise projects that commit to Environmental, Social and Governance principles, and access to capital for large infrastructure projects is likely to contain sustainability requirements.

That the focus of the PGII is on the sustainability and the social impact of these projects in Africa is further evidenced in the White House briefing room statement issued at the launch in June 2022, where it was stated that the PGII will “mobilize hundreds of billions of dollars and deliver quality, sustainable infrastructure that makes a difference in people’s lives around the world…”

By: Michael Foundethakis, Baker McKenzie’s Global Head of Projects and Trade & Export Finance, and Africa Steering Committee Chair

-

Op-Ed3 days ago

Op-Ed3 days agoSam Tayengwa: Navigating the Future of Insurance in Africa

-

Corporate Citizenship3 days ago

Corporate Citizenship3 days agoHuawei 2024 ‘Seed for Future’ Programme Kicks off in Kenyan Tertiary Institutions

-

Press Release12 hours ago

Press Release12 hours agoTelCables’ Partner Program is shaping the future of digital connectivity in West Africa