Oil and Gas

Egypt to raise gas exports to Jordan to100 mcf/day by January

Gas field of Egypt – REUTERS

CAIRO – 26 November 2018: “Egypt has been exporting amounts of gas to Jordon since September and it will raise the amount to 100 million cubic feet per day by January,” Jordanian Energy Minister Hala Zawati said.

Jordan announced in August that it is going to amend the agreements with Egypt for the sale and purchase of natural gas.

The Jordanian Ministry of Energy clarified in a statement that the new amendments will allow Jordan to import enough natural gas from Egypt to cover 10 percent of its electricity generation needs.

“These amendments will be carried out early 2019,” Zawati said previously.

The Egyptian minister of petroleum announced in March that the Egyptian natural gas would be re-pumped to Jordan as of early 2019 after fouryears of suspension.

Jordan needs about 330 million cubic feet of natural gas per day to generate electricity.

Egypt stopped importing liquefied gas in September after adding 1.6 million cubic feet to its production from its latest gas discoveries, including West Delta’s Taurus and Libra fields, as well as the Atoll and Zohr gas fields.

Egypt’s production of natural gas increased in December 2017 to reach 3.4 million tons, up from 2.7 million tons in December 2016.

In 2015, Eni discovered Zohr gas field, the biggest gas field in the Mediterranean, with an estimated production of 30 trillion cubic feet.

The second phase of Zohr gas field will add around 2 billion cubic feet per day to Egypt’s production and will be completed before the end of the year, according to the minister of petroleum.

The country’s total natural gas consumption is about 6 billion cubic feet per day, of which roughly 65 percent goes to the electricity sector.

– EGYPT TODAY

Oil and Gas

TotalEnergies, Chevron Push for Faster Permits, Better Seismic Data in Africa

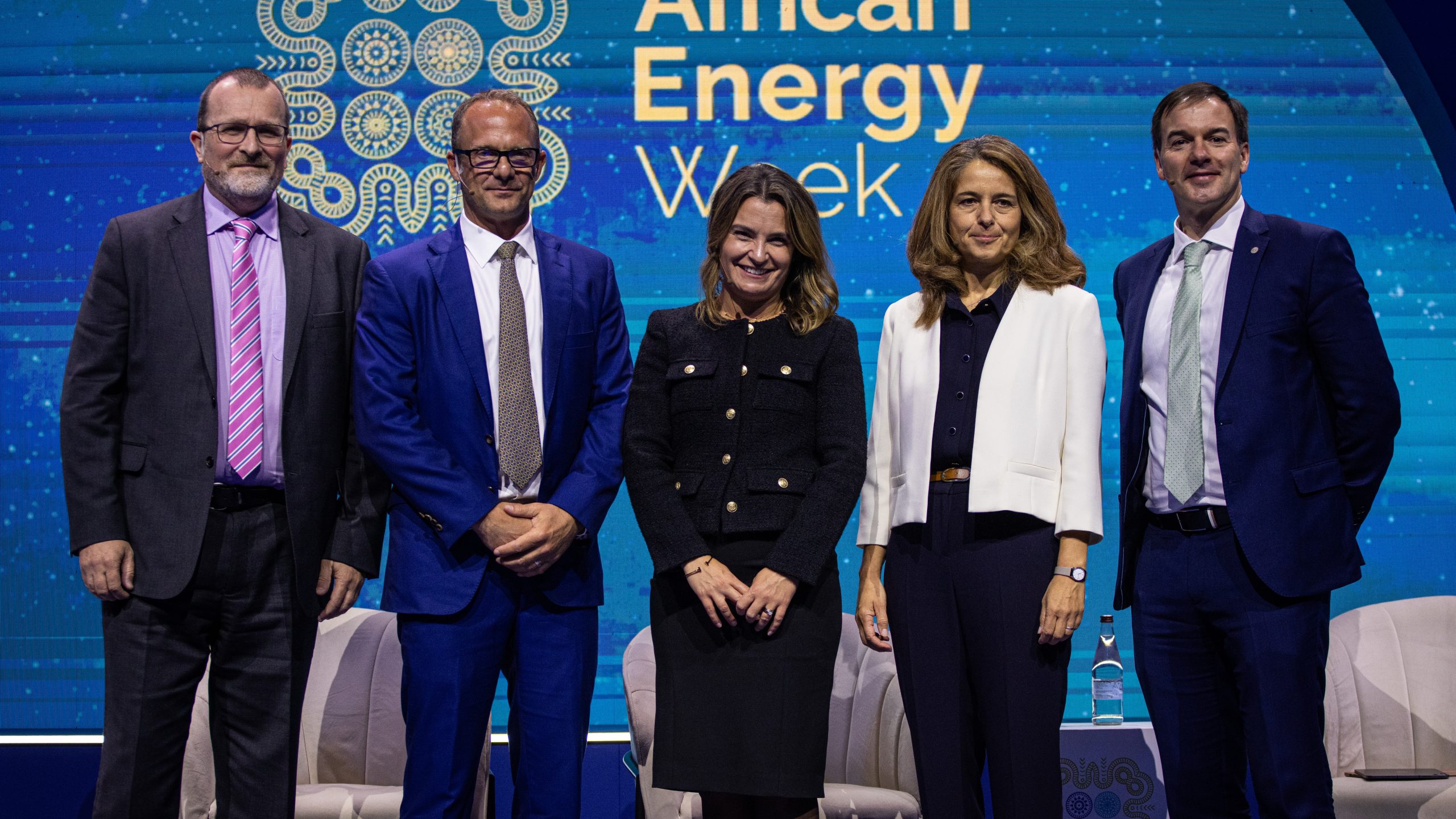

Africa’s oil and gas sector could be on the brink of a new exploration renaissance, driven by advances in seismic imaging, frontier data sets and faster permitting, industry leaders said at Africa Energy Week (AEW): Invest in African Energies 2025 in Cape Town on Wednesday.

According to Emmanuelle Garinet, VP of Exploration Africa at TotalEnergies, Africa’s frontier basins hold significant volumes. She pointed to Namibia as an example of how seismic and subsurface data can de-risk projects: “When we decided to drill the Venus well, it was frontier, but we had a probability of success of more than 50% because of the seismic data and direct hydrocarbon indicators.”

In the Republic of Congo, TotalEnergies’ exploration permitting process is moving at a markedly faster pace. “We got our permit in less than six months and are preparing for drilling by the end of the year,” Garinet said. By contrast, South Africa’s permitting system has faced delays due to legal challenges, a problem she described as “unacceptable” given limited budgets for global exploration.

Chevron’s CEO, Gavin Lewis, emphasized the critical role of comprehensive subsurface datasets in Africa. “Before you can do any AI-driven workflows, you need a dataset that illuminates what the subsurface looks like,” he said. “What Africa has lost is the ability to sponsor multi-client subsurface datasets. The only basin that allows for large, regional high-quality datasets is the Gulf of America, which has allowed that basin to reinvent itself multiple times.”

VP of Exploration for bp, Bryan Ritchie, highlighted survey work in Egypt’s Nile Delta, where the company completed the first deepwater ocean-bottom node seismic survey over the Atoll field and noted that the Egyptian Natural Gas Holding Company plans to expand multi-client data coverage across a larger area of the delta. ‘We’re seeing new opportunities for these images,” he said.

Beyond exploration, Woodside Energy’s VP of Exploration, Terry Gebhardt, said geoscience and subsurface data are also key to carbon capture and storage projects, as well as “maximizing efficacy and recovery” in existing fields.

The panel discussion, sponsored by EnerGeo Alliance, also underlined the broader scale of investment in Africa’s oil and gas sector. Nikki Martin, President and CEO of EnerGeo Alliance, said African oil and gas capital expenditure is expected to rise to $54 billion by 2030, following a $6 billion surge in exploration spending in 2024.

Oil and Gas

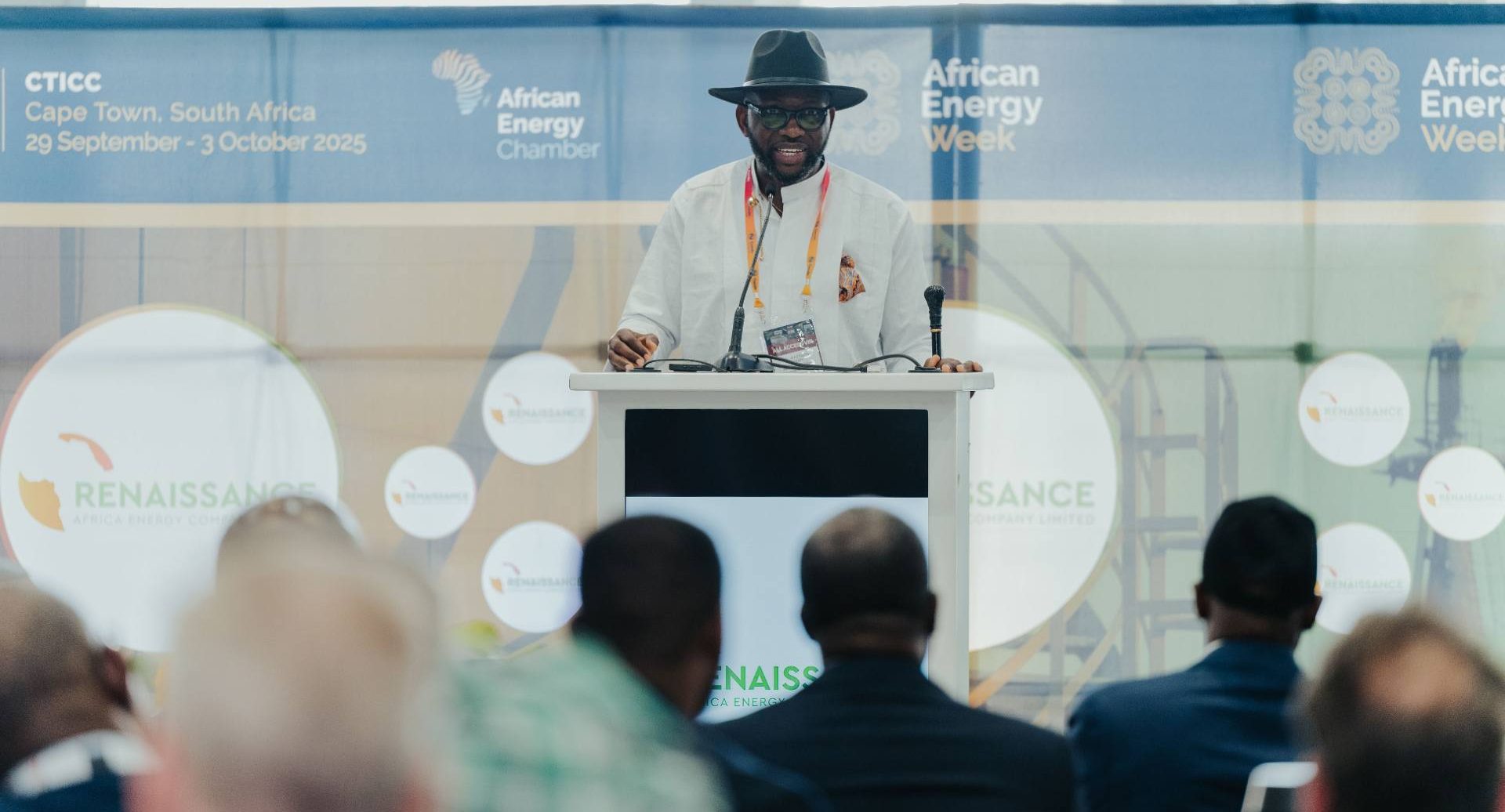

Renaissance Seeks Partners to Unlock Nigeria’s Oil, Gas Potential

Renaissance Africa Energy – a consortium of five energy companies – has announced it is seeking partners to help grow its portfolio and drive oil and gas development in Nigeria. The announcement was made by Tony Attah, Managing Director and CEO of Renaissance Africa Energy during a briefing at African Energy Week (AEW): Invest in African Energies 2025.

“We are born in Nigeria and made for Africa,” Attah stated, adding, “We strive to be Africa’s leading energy company, enabling energy security and industrialization in a sustainable manner.”

During the presentation, Attah highlighted a strong portfolio of investment opportunities for companies to partner with Renaissance Africa Energy in Nigeria’s oil and gas sector. He noted that extensive infrastructure supports the company’s portfolio of 18 blocks – 15 onshore and 3 offshore – 46 producing fields, 643 active conduits, 29 flow stations and five gas plants.

Meanwhile, Attah also announced Renaissance Africa Energy’s growth ambitions to support its ambitions to become a pan-African oil and gas company. The company has set a target to increase liquid production to 500,000 barrels per day by 2030 and 1 billion cubic feet per day of domestic gas supply.

In March 2025, Renaissance Africa Energy – a consortium comprising ND Western, Aradel Holdings, First Exploration and Petroleum Development Company, Waltersmith Group and Petrolin Group – completed a $1.3 billion acquisition of energy major Shell’s offshore subsidiary the Shell Petroleum Development Company of Nigeria.

The company stated that its vision is to be Africa’s leading energy company, enabling energy security and industrialization across the continent in a sustainable way.

Oil and Gas

Petroleum Industry Bill (PIB) Will Strengthen Nigeria’s Oil Industry

Petroleum Industry Bill (PIB) was introduced to the National Assembly in 2007 contrary to all Nigerians expectations the Bill, in its wholesale form, has survived three presidents and four convocations of the National Assembly but its passage will not sacrifice thoroughness on the altar of speed, because it will be in the nation’s best interest and we all believe this is the time to pass it.

Everyone has been waiting for the passing of the Petroleum Industrial Bill. This is the bill that is on the lips of every Nigerian whether he knows anything about petroleum or not and it is the most popular in the country.

Why it became the most popular because oil represents the live wire of our state and remains one of the most important pieces of legislations that the country needs. The passage of this very important piece of legislation will give room for meaningful progress to be made in the oil and gas industries in particular, and Nigeria in general.

Nigeria host the world’s 10th largest Petroleum reserve at about 25 billion barrels with Gas reserve of 166 Trillion Standard Cubic Feet (TSCF). It is indubitable that Nigeria with the largest reserve in Africa has significant untapped hydrocarbon potential available to advance her economic goal.

Before bill being forwarded to the National Assembly in 2007, Nigeria does not have a comprehensive law for the administration of the sector but has about 16 Petroleum Acts many of which overlapped in functions and responsibilities.

Even though a splinter Bill named the Petroleum Industry Governance Bill (PIGB), was passed in 2018 by the 8th National Assembly, failed to receive the prerequisite Assent of the President of Nigeria and thus could not become law.

Looking at the OPEC projection that by 2040 oil industry sector is going to be playing less and less a role in global energy usage. If the projection come true in the next 20 years from now the world’s dependence on oil would have reduced to 50 percent. So, whichever way you look at it, it appears that the days of oil are numbered. Regardless of this projection the nation oil and gas needs a comprehensive legislation that will help the country to generate more revenue because Nigeria has lost so much revenue that could have accrued to government coffers, as existing investments are stalled and potential investors are scared of coming.

Therefore PIB also seeks to address the problem of administering petroleum resources in line with global best practices, and to provide for efficient and independent sector regulation. PIB is also to promotes safe and efficient operation of the transportation and distribution infrastructure for the petroleum industry and the framework for developing third party access arrangements to petroleum infrastructure.

Bill have top priorities of Host Communities which seeks to protect and hasten the development of host communities. Section 234 to enhance peaceful and harmonious coexistence between licenses or lessees and host communities, and create a framework to support the development of host communities and foster sustainable prosperity within host communities. It also provides for direct social and the economic benefits from petroleum operations to host communities. Section 235 also provides for the incorporation of the Host Communities Development Trust. Once this PIB is passed and assented to by Mr. President, the present upheavals rearing theirs ugly heads within the host communities in the oil producing area and elsewhere will fizzle out and die a natural death.

PIB also seeks for the establishment of Downstream Petroleum Regulatory Agency (DPRA) aimed to regulate the downstream sector of the petroleum industry. Its functions include regulating the technical aspects of the downstream sector; regulating the commercial aspects of the industry as may be designated by the Minister; the issuance of downstream licenses to industry operators; and the facilitation of an enabling environment for investments in the downstream petroleum sector.

Henceforth the PIB also seeks for the commercialization of the Nigerian National Petroleum Corporation (NNPC) to become Nigerian National Petroleum Company Limited; the bill proposes that the NNPC Ltd will be incorporated under the Companies and Allied Matters Act by the minister of petroleum as the ownership of all shares in NNPC Ltd shall be vested in the government at incorporation and held by the Ministry of Finance incorporated on behalf of the government.

Section 53(5) says shares held by the government in NNPC Ltd are not transferable, including by way of sale, assignment, and mortgage or pledge unless approved by the government. Subsection 7 says, “NNPC Ltd and its subsidiaries shall conduct their affairs on a commercial basis without recourse to government funds. Section 55(4), however, says the cost of winding down the assets, interests and liabilities of NNPC shall be borne by the government.

Last year 9th National Assembly achieved a landmark when President Muhammadu Buhari has signed the Deep Offshore and Inland Basin Production Sharing Contract (PSC) Amendment Bill into law. The provisions of the Act stipulate that the law shall be subject to review to ensure that if the price of crude oil at any time exceeds $20 per barrel, the share of the revenue to the Nigerian government shall be adjusted under the PSC.

Finally Petroleum Industry Bill will create efficient and effective governing institutions, with clear and separate roles and to establish a framework for the creation of a commercially oriented and profit-driven national petroleum company in addition of promoting exploration and exploitation of petroleum resources in Nigeria for the benefit of the Nigerian people and the efficient, effective and sustainable development of the petroleum industry.

Written by: Abdullahi Gaya Wrote in from House of Representative Abuja

-

Afripreneur1 day ago

Afripreneur1 day agoRevolutionizing Cross-Border Payments in Africa: An Exclusive Interview with Onyinye Olisah

-

Oil and Gas3 days ago

Oil and Gas3 days agoTotalEnergies, Chevron Push for Faster Permits, Better Seismic Data in Africa

-

Energy3 days ago

Energy3 days agoUnited States (U.S.) Political Will, African Reforms Signal New Era for Energy Investment

-

Op-Ed3 hours ago

Op-Ed3 hours agoThe Black Friday remix: What 2025 will look like after a rule-changing 2024

-

Op-Ed1 hour ago

Op-Ed1 hour agoThe rise of the “shadow employee”: When ex-employees still have access