Investing

ARM Holding Company Lists 6 Mutual Funds on Cowrywise

Today, Mutual Funds from Asset & Resource Management Holding Company (ARM) can now be accessed through Cowrywise. These new mutual funds, managed by ARM Investment Managers, swell the growing list of SEC-registered mutual funds now easily accessible on Cowrywise by retail investors nationwide. Also, this deepens our position as the platform with the highest collection of mutual funds in Nigeria.

Meet ARM: One Of Nigeria’ Top Asset Managers

Established in 1994, as an asset management firm, ARM, is Nigeria’s largest non-bank financial services firm with the primary objective of providing a platform that meets all the investment needs of individuals. ARM Group’s retail products comprise mutual funds, estate planning services, wills, pension, stockbroking services, and real estate.

Currently, it manages 6 mutual funds and all of them are now available on Cowrywise. Get them here with any comfortable amount. This partnership with ARM dovetails into our commitment to help change the way Nigerians invest.

Speaking on the collaboration, Henrietta Bankole-Olusina; Managing Director, ARM Financial Advisers, stated; “Our goal is to empower more individuals to fulfil their dreams and encourage them to imbibe a healthy investment habit. Our range of mutual funds caters to different needs depending on their investment goal and risk profile.

How Do Nigerians “Invest”?

In 2019, when mutual fund assets hit the ₦1 trillion mark, Nigerians spent ₦730 billion on sports betting. That means, in 2019, 73% of the industry’s total value was equal to what Nigerians spent betting in just one year. Diving deeper into the report, we see that the drivers for this adoption are:

• Affordability

• Ease of access

• Ease of understanding

• The hope of expected returns

Sadly the adoption of betting has done more harm than good in general. Hence, to place people on a sustainable path of wealth there is a gaping need to make investments simple and clear about their rewards.

Starting in 2017, we launched into the market with a digital savings product. The process was (and is still) simple, people save any comfortable amount and we help invest the bulk in treasury bills and bonds to earn returns. Alongside, we curate a robust finance education system that simplifies money for the everyday person.

These efforts positioned us to initiate our core plan of helping everyday people access high-end investments through mutual funds. On May 21, 2019, we started off with four mutual funds. Today, we have nineteen high-profile mutual funds.

The Journey To 10 Million First-time Investors

Partnering with top fund managers across the country, we will bridge the gap of onboarding and educating the average Nigerian. In essence, we are easing up more time for fund managers to grow wealth while we drive up demand. Our commitment is to introduce 10 million first time investors to mutual funds in the next five years.

ARM Mutual Funds: The Details

The ARM suite of mutual funds is a diverse one. Its offerings fit the desires of various types of investors. Below are its current offerings.

• ARM Money Market Fund: this is a low-risk fund that invests in instruments like treasury bills. A good fit for short term investors.

• ARM Fixed Income Fund: like other fixed-income funds, this is a medium-risk fund. It’s a great option for medium to long term goals, as it can serve as a source of steady income.

• ARM Ethical Fund: helps investors put their money in firms that align with a strict ethical selection.

• ARM Discovery Balanced Fund: designed for a balance between equities and fixed income. It’s a medium-risk fund.

• ARM Aggressive Fund: got a long-term view? This is your fund. Though high-risk, it helps your investments grow over the long term.

• ARM Eurobond Fund: this fund gives you access to investment instruments denominated in United States’ Dollars. Also, it is excellent for protecting your investments from currency depreciation.

ARM Funds on Cowrywise

Today, all above-listed funds, and thirteen others, are accessible on Cowrywise with any amount and in few clicks. There’s no better deal than this. We say this as the number one marketplace for mutual funds in Nigeria.

Currently, we offer the most diverse basket of mutual funds in Nigeria. To top that up, we provide relatable advice at no extra cost and you get to invest with any comfortable amount.

To buttress this, Yarmirama Ashama, Product Manager at Cowrywise, described the recent partnership as an expansion of the opportunities that come with investing with mutual funds. In her words, “We cannot raise a new generation of investors alone. This is why partnerships with fund managers like ARM are important. Having them onboard feeds this vision, and we are excited about the results that will follow.”

Confused about what fund to pick? Check this guide.

How to Invest in ARM Funds

To start investing in a few minutes, follow these steps:

• Signup here

• Tap “Invest in Mutual Funds”

• Start investing

How to List your Fund as a Fund Manager

Over the past year, we have opened up the retail market for top fund managers. With a bespoke retail and onboarding process, we have brought a younger demographic of first-time investors into the mutual funds’ space.

Currently, our audience age range sits between 21 and 35 years. If you want to improve the visibility of your funds to this demography, you should join us on the journey to 10 million. Please send an email to mutualfunds@cowrywise.com.

Got questions about how mutual funds work? Start with this guide.

Issued by Cowrywise

Investing

Goodwell Investments leads USD 8.5 million Series B round for Good Nature Agro

Impact investor Goodwell Investments has joined forces with social impact investing cooperative Oikocredit and Global Partnerships/Eleos Social Venture Fund (GP SVF) to provide USD 8.5 million in equity to Zambian social enterprise Good Nature Agro (GNA).

Good Nature Agro currently supports about 30,000 southern African smallholder farmers in growing drought-resistant, early-maturing legume seed varieties, including beans, cowpeas, soyabeans and groundnuts. Its agritech-based business model encompasses access to inputs, input finance, smart and reduced fertiliser use, climate-smart training, and a guaranteed market for high-value produce, giving farmers a wealth of support to professionalise their businesses and establish a clear path out of poverty.

In line with Goodwell’s mission to support innovative African companies that are contributing to a more inclusive society, the organisation first invested in Good Nature Agro in 2020 via its uMunthu I fund. In the years since, GNA has continued to expand its ambitions and reach, consistently growing farmers’ productivity and incomes, as well as improving their access to finance. In addition, the company has recently opened a new factory in Lukasa.

To enable GNA’s next phase of growth, Goodwell Investments led the company’s series B round, partnering with Oikocredit and GP SVF to raise a total of USD 8.5 million. With this new investor capital, GNA aims to grow its client base to 50,000 farmers by 2027. It will also deepen its engagement with its clients, improve its integration of whole farm income, develop new genetics to deliver greater yields and resilience, and innovate to keep its clients at the centre of agricultural supply chains.

Neo Maruatona Ratau, the Investment Director at Goodwell Investments, eagerly anticipates GNA’s future accomplishments, stating, “The remarkable growth GNA has experienced since our initial investment has been impressive. We have observed the company’s ability to deliver robust financial returns and make a significant social impact, all thanks to its farmer-centric business model, which effectively integrates smallholder farmers into the agricultural value chain. We are delighted to collaborate with investors Oikocredit and Global Partnerships to support GNA’s upcoming growth phase, which will be fueled by the convergence of digital and financial inclusion, along with strategic inorganic growth initiatives.”

Samuel Kibiri, Oikocredit’s Equity Officer for Africa, is equally enthusiastic about GNA’s potential for creating impact, saying, “Our new partnership with Good Nature Agro will enable Oikocredit to help more low-income African farmers improve their livelihoods through improved yields and access to markets. We’re delighted to be co-investing with like-minded investors in an innovative business with a clear mission to move farmers out of poverty.”

Finally, Jim Villanueva, Managing Director of GP SVF at Global Partnerships, is confident in GNA’s ability to continue to deliver remarkable results, saying, “We first invested in GNA during their seed round in 2018 and have witnessed the enterprise’s ability to adapt and scale its offering to enable farmers to increase and diversify their incomes, in the face of both climate change and gender inequality. We are proud of the results achieved to date and the opportunity to support GNA in this next chapter of growth and impact.”

Reflecting on the new investment, Carl Jensen, CEO of Good Nature Agro comments, “Good Nature has broken the boundaries of most agribusinesses by engaging the full value chain – connecting growers, aggregators, processors and consumers – and delivering exceptional service through a hybrid tech and ‘boots on the ground’ model. We very much welcome Oikocredit as a new investor, endorsing our approach and potential, and are equally grateful for the partnership and trust of our existing investors Goodwell and GP SVF who participated in this round.”

Investing

Egypt’s BONBELL seeks $10 million seed funding after closing $350,000 initial round

Egypt’s startup BONBELL, the first mobile App in the Food-tech industry specialized in food ordering, digital solutions for table and meal reservations, has closed an initial funding round for $350,000. This is through a Canadian Angel investor, to help further develop the App services and achieve a level of growth in regard to user count and daily orders.

BONBELL launched its own App in early 2022, to offer a wide range of food ordering services in Egypt. The App offers many food ordering solutions, from food delivery to restaurant’s reservations and Dine-in ordering through a QR Code on the tables, as well as take away services. The App offers various payment solutions through cash or credit cards.

BONBELL has partnered with many restaurants and cafes, as well as clubs like Heliopolis Club and Smash Club. It also offers its services in Malls and Cinemas, to offer a smoother food ordering experience, reserving tables and food delivery, for mall and cinema goers. It has also strategically partnered with many leading major companies and institutions. Most notably the German University in Cairo (GUC), and Raya Telecom, in order to offer its services in their respective headquarters for employees and visitors alike.

The Food-Tech startup targets raising its partnered restaurants to 750 by the end of 2022. The company is also negotiating with two venture capital funds from Europe and the Gulf, to close a $10 million fund in its seed round by the end of the year.

Doaa Abdel-Hameed, the Chief Business Officer of the company said: “we aim to help restaurants in offering an easier food ordering experience to their customers. Either through food delivery or reserving a table in the restaurant, as well as taking away orders and also the special orders made by customers in their restaurants.”

“We pursue a better experience for the Egyptian user in food ordering. We see a lot of potential and opportunities to do that through developing the App constantly based on the user reviews. And adding more restaurants in all of the Egyptian governorates.” She added.

BONBELL has earned the trust of more than 12,000 customers, who used the app in food ordering in all the ways offered through the App, in just 6 month.

Doaa Abdel-Hameed emphasized that the success of BONBELL App, in offering the best experience to its users can only be done through strategic partnerships with many more restaurants. In addition to the constant development of the technology used in the App, as well as relying on offering inventive solutions to the Egyptian user such as (Robotic Stations) service.

This service will offer customers the experience of food ordering and serving through a Robot, without any human intervention. It is expected to launch in Egypt at the end of 2023.

Investing

Dream VC applications: A peek behind the scenes

Dream VC breaking down the numbers and representation in its programs

A year ago, Dream VC quietly launched its first inaugural cohort applications with the hopes of closing the investing knowledge gap for check-writers and ecosystem builders across the continent. Fast forward one year later, they have received an overwhelming amount of interest from people curious about investing and contributing to the African startup ecosystem. Across two cohorts alone, they have processed more than 2000 applicants from 30 African countries. With fellows dialing in five continents and multiple time zones.

That being said, they’d like to share some interesting findings they have extracted and learned from the whirlwind that Dream VC has been in from last year to now.

Cohorts

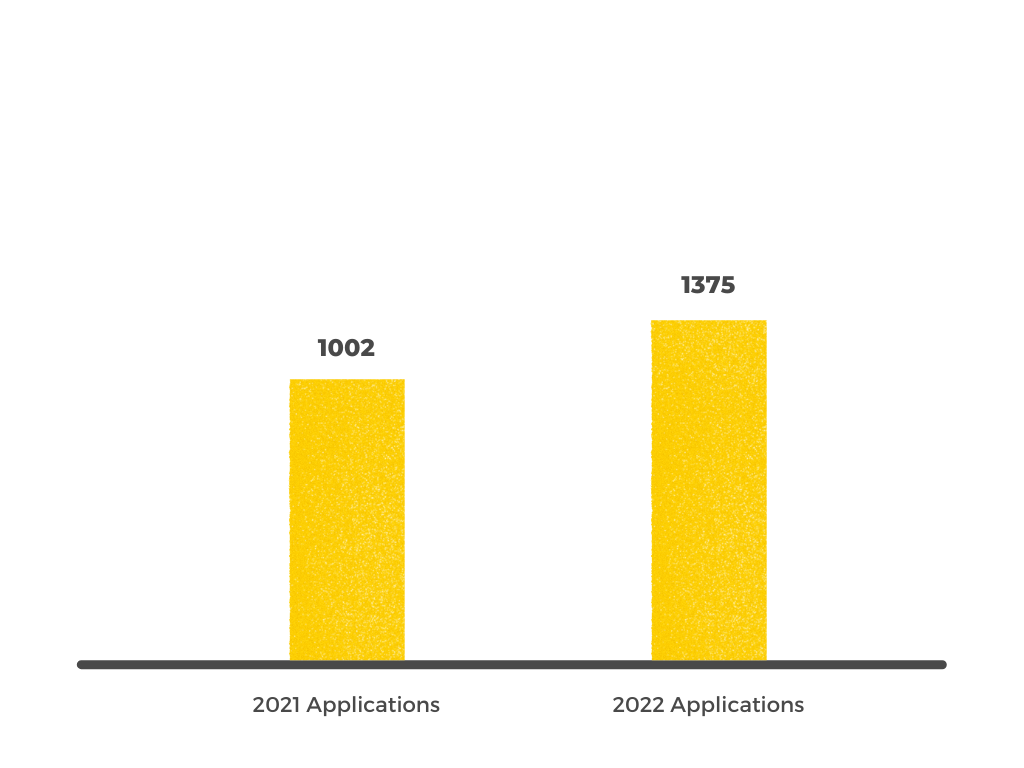

By the end of 2022, Dream VC will have 2 cohorts under its belt with 3 programs run. There has been an increase in total applications despite the difference in price point between the 2021 program and this year.

Breakdown Of The 2021 Cohort

For its inaugural cohort, they received a total of 1002 applications and had an intake of 31 fellows, with an acceptance rate of 3%. The average age of its fellows was 25, with most being in their mid-twenties to late twenties. And exploring VC as a new career pivot after a few years of full-time work experience. After 4 months of rigorous and community-driven engagements, a total of 19 Fellows graduated from the program with an issued certification.

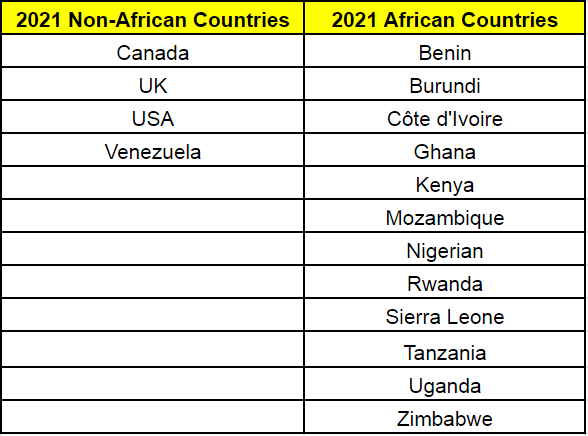

When looking at the specific demographics of Dream VC’s inaugural fellows, findings show that 90% of the fellows were homegrown. Which they classified as having been born, raised, and educated on the continent. They also had 12 African countries represented and 16 different Nationalities in total.

Although its initial intake consisted of 33% women, the final certified graduating fellows consisted of 60% women. Meaning that all of the female fellows who joined the fellowship finished the program.

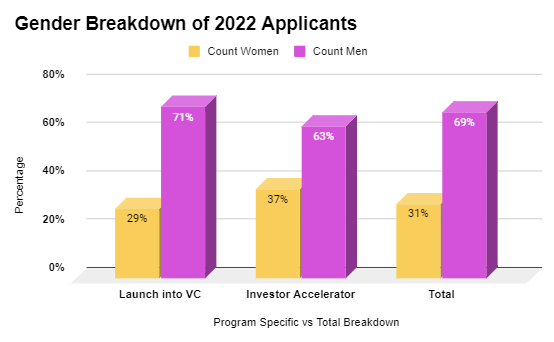

This is a strong indication of the perseverance of its female fellows in particular. And they are committed to making a strong push to convert more women into its talent pipeline. Especially given that only 15% of the 2021 applicants identified as female. At Dream VC, they urge more women to apply for its programs and also reapply for future cohorts if they were not accepted initially.

Breakdown Of The 2022 Application Cycle

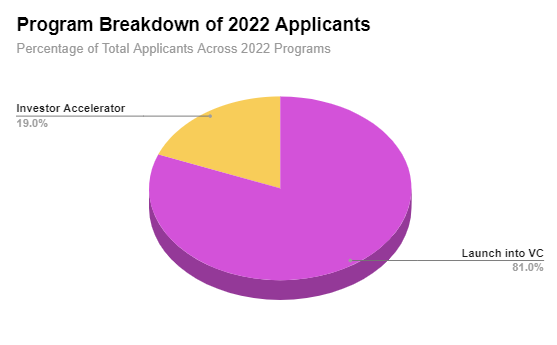

For 2022, Dream VC opened its applications on March 8th and had then remained open for over a month and a half until its final deadline on May 1st. In total, they received a total of 1,375 applications for its Launch into VC (“LIVC”) and Investor Accelerator (“IA”) programs.

Around 81% of the total applications were for our Launch into VC fellowship, and the remaining 19% were for the Investor Accelerator. We received a total number of 1,113 applications for Launch into VC, and 262 for Investor Accelerator.

Gender Breakdown

Out of the total applications for 2022, 31% of the applicants identified as female. When taking a closer look at the gender breakdown for each program, Investor Accelerator had a higher percentage of female applicants with 37% of total Investor Accelerator applicants, while Launch into VC had 29%.

Nationality Breakdown

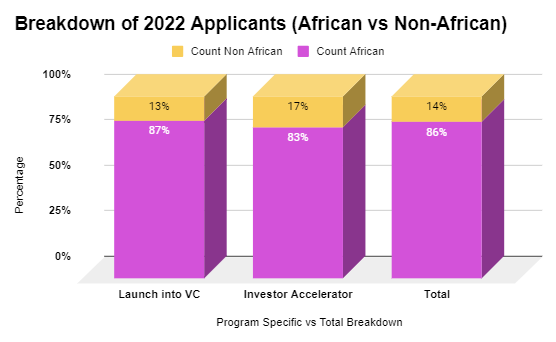

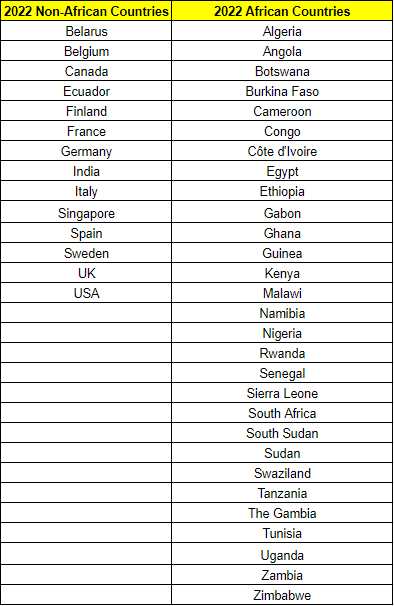

When reviewing the nationalities of the applicants, it was found that for 2022, Dream VC has exponentially expanded its reach of applicants in both nationality and location. However, most of the applicants are still overwhelmingly from the continent and diaspora, which accounts for 86% of the total applicants. The remaining 14% hail from non-African countries such as India, Singapore, and Germany with non-African backgrounds.

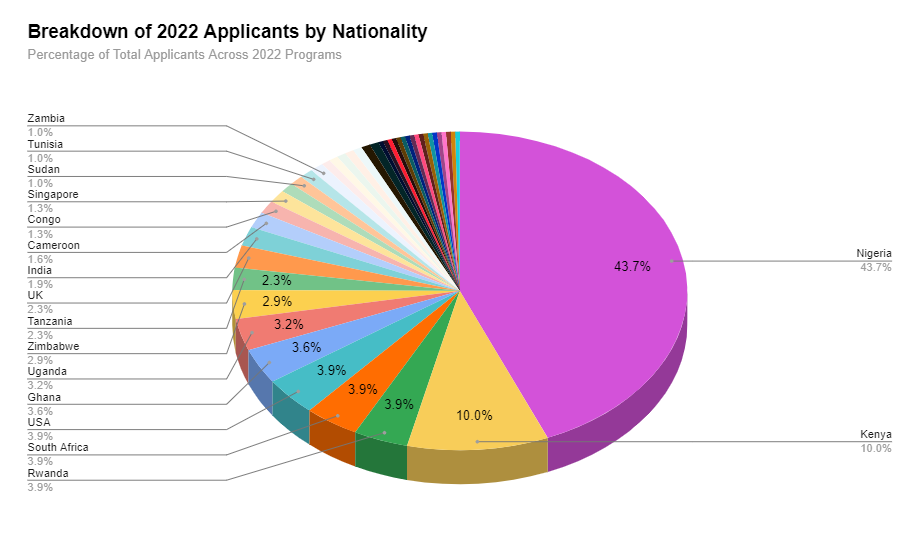

When looking more closely at each program, 87% of the applicants for Launch into VC applicants were homegrown or African diaspora, compared to 83% of the Investor Accelerator applicants. This year saw 30 different African countries across the continent represented. With a majority of the applicants coming from Nigeria (43.7%), followed by Kenya (10%), Rwanda and South Africa (3.9% each respectively), Ghana (3.6%), Uganda (3.2%), Zimbabwe (2.9%), and Tanzania (2.3%).

Interestingly, the country represented the most by the diaspora applicants was Cameroon, followed by Nigeria, across both programs.

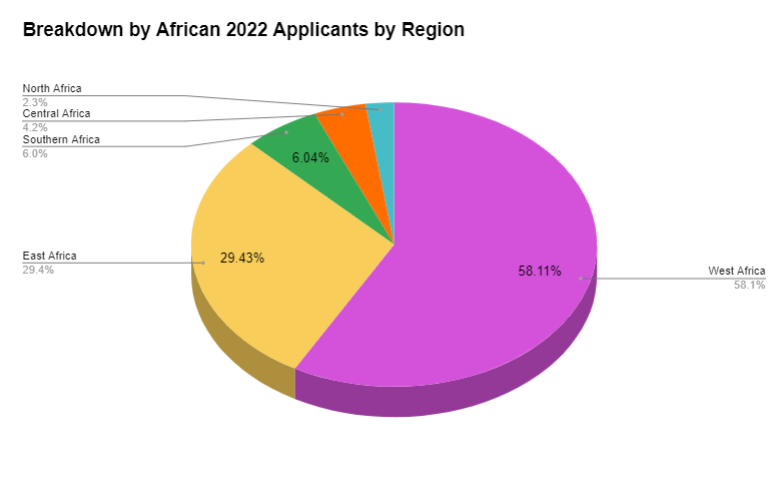

Across the different African regions, West Africa took the lead in applicants with over half of the applicants hailing from the region (58%). East Africa contributed to another quarter with approximately 29% of applicants coming from the area, followed by Southern Africa (6%), Central Africa (4%), and finally North Africa (2%). Dream VC’s footprint can still be solidified further, particularly in the ecosystems in North Africa, and its team will be traveling actively to Egypt, Morocco, and Tunisia to build relationships there.

Locations Breakdown

When looking at the locations of applicants applying from outside the continent (including diaspora and non-Africans), over 50% of them applied from the United States and the United Kingdom. Dream VC also saw an increase of Indian and Singaporean applicants from Asia. And a spread of interesting European countries including Belgium, Belarus, Germany, France, Finland, and Sweden.

Closing Remarks & Reflections

Since launching Dream VC in 2021, the team has been endlessly grateful for the overwhelming interest from the African & International community. As well as the selfless support that has been extended by various ecosystem partners and connections in our network.

Its application cycles have revealed several interesting insights into where the strong interest can be found in various startup ecosystems. As well as certain areas we are endeavoring to have better reach in (ex: North Africa and Arabophone countries).

They also strongly encourage more female applicants to apply AND reapply to its programs. As they are strongly committed to building out the opportunity and talent pipeline for black women in particular focused on investing in Africa.

-

Afripreneur10 hours ago

Afripreneur10 hours agoRedefining Real Estate Marketing: An Interview with Imelda Usoro Olaoye, Founder of Thinkmint

-

Afripreneur9 hours ago

Afripreneur9 hours agoOluchi Anoruo on building SmartPharm and addressing access to healthcare products

-

Economy14 hours ago

Economy14 hours agoMeta Hosts its First Youth Summit in Nigeria to Drive Innovation and Empowerment

-

Technology14 hours ago

Technology14 hours agoLG’s Brand Reinvention: A Global Success Story