Legal Business

5 important features to make your contract legal and valid | Tosin Omotosho

Contracts are a big part of commercial transactions. As a matter of fact, your company is set up to sell either physical goods or intangible services. That is a contract of sale. Apart from the basic contract of selling, your company will enter series of contracts, so it is important to note what makes a contract legal and valid.

A contract is a legally binding agreement between two or more parties and for it to be valid; it must have these essential features.

Firstly, there must be an offer by one party and acceptance of that offer by the other party (ies). For example, Worldwide Nigeria Limited (a fictitious company name) needs a legal adviser for their company; they reach out to our law firm Charis Legal Practice and make us an offer. We accept their offer and we both agree on scope of our services which they need, the duration of the transaction and other important details (acceptance).

We have a written contract containing all the necessary details of our business arrangement which representatives of the company and the law firm sign.

Secondly, there must be consideration, meaning a party will give the other party something in return for the stated benefits. Each party has a benefit to be gained from the other party and in exchange for that, it has obligations to fulfill towards that party. As in our example above, W Nigeria Limited agrees to pay #X million naira as fees in exchange for the legal services our law firm will provide.

Please note that consideration doesn’t have to be money all the time, as long as it is something of value. For example, trade by barter where an interior decorator may exchange his / her services for the services of a digital marketer.

Thirdly, there must be an agreement or consensus. This is the bedrock of all contracts. Both parties must agree on all the necessary details that the contract entails. It is at the point of agreement that they sign the written contracts. As a matter of fact, there is no binding contract until the parties have agreed.

So W Nigeria Limited and Charis Legal Practice agree on the terms of the contracts e.g fees, mode of payment, mode of delivery, duration, scope of services etc, and include it in a contract.

Next and of utmost importance is that a contract must be for a Lawful purpose. You can enter a contract to do something lawful only. An agreement between two people to defraud another person or give kickbacks for example cannot be a contract as it is not for a lawful purpose.

Finally, the parties must intend to create a legal relationship. This means they both agree that if a party doesn’t do what he or she agreed to under the contract, the court can compel that party to comply. The relationship between Charis Legal Practice and W Nigeria Limited is a lawyer client relationship and if any of the parties fails to carry out their obligations under the law, the law will take it course.

There you go, these are the five essential building blocks of a legal and valid contract.

Do you have a question? Do type them in the comment section or send me an email here and I will respond as soon as I can.

Author:

Tosin Omotosho is a business lawyer. She helps business owners give legal structure to their business, implement best legal practices and avoid unnecessary liabilities caused by legal mistakes. With a career spanning more than a decade, she has been lawyer to organisations in the agriculture, advertising, real estate and technology industries among others. An avid reader and writer, she is the Principal Partner, Charis Legal Practice, a law firm based in Lagos. Contact her here, follow her here on instagram to get more helpful legal tips and to read more of her articles, click here.

Legal Business

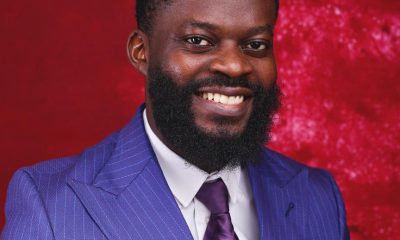

The Art of Law Firm Leadership: A Conversation with Abayomi Adebayo, Managing Partner at Mavericks & Mages LP

Abayomi Olakunle Adebayo is a distinguished legal expert and strategic leader serving as Managing Partner at Mavericks & Mages LP and founder of MavericksAI. He delivers innovative, client-focused legal solutions across regulatory compliance, corporate governance, complex transaction structuring, and international commercial law. Abayomi combines deep legal expertise with keen business insight to support organizations operating in highly regulated sectors such as financial services, mining, oil & gas, infrastructure, and emerging technologies. As the founder of MavericksAI, the firm’s AI-powered legal automation brand, he champions cutting edge technology to transform legal service delivery. In this exclusive interview with Alaba Ayinuola of Business Africa Online (BAO), Abayomi speaks on his experiences, insights, and perspectives on law firm leadership, deep understanding of the legal industry and passion for innovation. Excerpts.

Alaba: As a managing partner, what are your top priorities for leading and growing Mavericks & Mages LP?

Abayomi: My top priority is to deliver innovative, client-centric legal solutions that align with the dynamic needs of our clients’ industries. Our approach and first strategy to achieving this is to have a deep understanding of our clients’ business models, risk appetites, organizational objectives, and regulatory environments to provide tailored, and strategic legal advisory and corporate governance services.

From a growth perspective, we emphasize speed, scalability, and precision by embedding AI-powered automation within our workflows. This integration boosts operational efficiency, enabling us to respond quickly and accurately while nurturing lasting client relationships. Over the years, we have by this strategy built trusted partnerships with leading organizations across diverse sectors including financial services, fintech, real estate, oil & gas, agriculture, mining, media, and entertainment. Many of our clients have grown substantially, with some progressively evolving into dominant market leaders and conglomerates.

We focus on emerging technologies like AI, robotics, blockchain and DeFi, providing regulatory guidance, licensing support, and compliance advice to innovative companies. Our services include advisory on data privacy, technology and IP protection strategies, and regulatory support for tokenization and digital assets. Additionally, we offer comprehensive transactional assistance, covering due diligence, structuring, and dispute resolution for tech projects. This expertise uniquely positions us to guide clients through the evolving landscape of these emerging technologies.

Alaba: What types of legal issues do you most commonly advise clients on, and how do you approach these matters?

Abayomi: At Mavericks & Mages LP, we specialize in advising clients on a broad range of legal matters, with bias for regulatory compliance, corporate governance, commercial transactions, and intellectual property protection. Our approach is practical and tailored: we take the time to understand your specific industry and regulatory environment, combining deep legal knowledge with strong business insight. This allows us to craft solutions that not only reduce your legal risks but also support your company’s growth and operational objectives.

For example, we guide some of our clients through obtaining and acquiring CBN licenses, managing due diligence, documentation, and regulatory interactions, with ongoing legal support. Our services also cover licensing and compliance for BDCs, finance houses, asset managers, and fintech startups. We provide corporate governance and company secretarial services, protect intellectual property, and conduct legal audits to strengthen compliance.

For international trade, we advise on contracts, payment security, and Incoterms. Additionally, we handle debt recovery, insolvency, restructuring, real estate transactions, dispute resolution, licensing, and representation before regulatory authorities. Our client-focused, tech-enabled approach helps us to deliver timely, compliant legal solutions that foster growth.

Alaba: How do you help clients navigate complex regulatory landscapes, and what strategies do you employ to ensure compliance?

Abayomi: Navigating Nigeria’s complex regulatory frameworks requires diligent monitoring, expert interpretation, and strategic application. We deploy a combination of real-time regulatory tracking, engagement with regulators, and customized compliance advisory that is specific to each client’s sector and business model. Our strategy involves continuous updates on statutory changes, deploying RegTech where appropriate, and conducting risk assessments that are both legal and operational.

We emphasize embedding compliance into business processes as a core strength, not just a checkbox, which enables clients to thrive sustainably while avoiding penalties. Our expertise across sectors like banking, trade finance, energy and agro-allied services ensures we tailor strategies that balance regulatory adherence with business agility.

Alaba: Can you briefly describe a particularly complex corporate governance issue you’ve advised on, and how you approached it?

Abayomi: One noteworthy instance involved advising a client within the financial services sector on board restructuring and compliance with the CBN’s stringent governance framework. The challenge was aligning board composition, ensuring independent directors’ roles, setting term limits, and establishing robust risk and audit committees while respecting existing shareholder dynamics.

Our approach was collaborative and meticulous: we conducted a governance audit, benchmarked against regulatory requirements and best practices, and structured a phased implementation plan. We also facilitated board training on governance duties and compliance. The outcome was a fully compliant board structure that enhanced transparency and corporate accountability, positioning the client to meet regulator expectations and strengthen investor confidence.

Alaba: What are some key considerations for boards of directors in ensuring effective corporate governance?

Abayomi: Effective corporate governance demands board independence, accountability, and clarity of roles. Boards must ensure separation between executive and non-executive responsibilities and engage in regular performance evaluations. Diversity and inclusion are increasingly important, enhancing decision quality and stakeholder representation. Boards should integrate sustainability and ESG initiatives into governance frameworks, aligning operations with environmental and social responsibilities to meet evolving regulatory and investor expectations.

Data security and digital governance, especially in the context of greater virtual meetings and AI adoption, are critical for protecting corporate secrets. Continuous board training and proactive risk management round out these considerations for high-functioning, resilient boards.

Alaba: What are some emerging trends or issues in corporate governance and regulatory compliance that you think are most important for companies to be aware of?

Abayomi: Key emerging trends include integration of AI and digital tools in governance for enhanced board management and compliance tracking. There is also the issue of growing regulatory scrutiny by bodies like CBN, SEC, NDPC, FRC, NAICOM and PENCOM, with stricter enforcement powers such as heavy sanctions, license revocation, and even sacking of boards.

Again, organizations need to understand the increasing importance of ESG frameworks and sustainability reporting as investors and regulators demand accountability for social and environmental impacts. There is also an ongoing push globally for greater boardroom diversity and inclusion, both gender and generational.

Other trends that they must be aware of are adoption of flexible, agile corporate structures that leverage virtual platforms while ensuring strengthened cybersecurity; and rapid evolution of financial and commercial regulations around fintech, digital assets, and data protection, all of which require continuous adaptation.

Alaba: Lastly, how do you see technology and innovation impacting the legal industry, and how is your firm adapting?

Abayomi: This manifests in two key ways: the growing demand for lawyers to leverage technology in their service delivery, and the critical importance of staying abreast of the evolving legal and regulatory regimes driven by innovation and technology.

Undoubtedly, any lawyer will acknowledge that technology is already transforming legal practice, shifting lawyers’ roles toward higher-level strategic tasks. However, this is only the beginning, as lawyers are increasingly recognizing the need to automate routine functions. For example, at Mavericks & Mages LP, through our brand MavericksAI, we lead in integrating AI-powered automation solutions that enable lawyers to work faster, smarter, and with greater accuracy.

Think of those repetitive tasks that consume significant portions of a lawyer’s time – drafting court processes, writing letters and notices, preparing transactional documents and agreements. Our AI Agents can handle these tasks swiftly and precisely, tailored to the lawyer’s preferred style, templates, and formatting, while ensuring data privacy and client confidentiality. This results in more consistent work with fewer errors, freeing lawyers to focus on critical legal strategy and client advice.

We also have AI tools that simplify tasks such as managing board meetings, capturing minutes, and preparing board reports, and improving contract review by identifying risks, key terms, and suggesting enhancements to ensure compliance with Nigerian laws. There are also AI-powered automations that lawyers can deploy to support their law firms in maintaining active online presence through human-in-the-loop automated content creation and social media management that aligns with the rules of professional conduct. They can also use AI for calendar management, regulatory updates, and compliance monitoring to keep their legal teams ahead.

Now, to the other aspect of the question, which is the impact of innovation and technology on legal and regulatory environment. No doubt, rapid technological innovation is creating new legal and regulatory challenges in areas such as data protection, blockchain, digital assets, NFTs, product liability for emerging technologies, and AI-generated content. These developments raise complex issues which require updated regulatory frameworks.

Some countries, including the U.S, have started enacting laws like the Clarity Act and GENIUS Act to address digital asset regulation, In Nigeria we have the ISA 2025 and SEC guidelines for cryptocurrency and digital assets but still need more comprehensive and business-friendly laws. For legal professionals, staying current with these evolving rules is critical. Integrating emerging technology topics into legal education and establishing clear practice directions will help lawyers provide effective, compliant advice while fostering innovation in a rapidly changing environment.

Legal Business

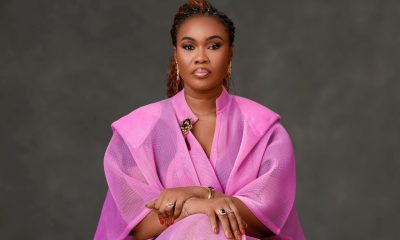

Building a Career in Law: Iguehi Onokevbagbe’s Journey, Insights and Advice

Iguehi Onokevbagbe is a certified Anti-Money Laundering Specialist and seasoned legal professional with over five years of experience spanning corporate law, banking and finance, compliance, and risk management. She has a proven record of delivering strategic legal solutions that enhance governance, mitigate risks, and promote financial integrity. Notably, she played a significant role in Nigeria’s successful defense in the USD 6.6 billion arbitral award case brought by Process & Industrial Developments Ltd. (P&ID), culminating in a favourable judgment by the Commercial Court of London on October 23, 2023. In this exclusive interview with Alaba Ayinuola of Business Africa Online (BAO), Iguehi shares valuable insights, expertise, and latest trends in the field. Exercpts.

Alaba: What motivated you to pursue a career in law, and how did you choose your current practice area?

Iguehi: I have always been passionate about justice and the role of law in strengthening institutions and shaping societies. For me, law is more than rules on paper – it’s a tool to ensure systems function effectively and people are protected. My career at the Central Bank of Nigeria exposed me to the intersection of law, financial regulation, and governance. That experience, combined with my interest in safeguarding integrity and promoting sustainable economic practices, motivated me to specialize in Anti-Money Laundering (AML), compliance, and financial regulation, where I can contribute meaningfully to protecting financial systems and supporting sustainable development.

Alaba: Can you describe your experience with corporate, banking, or finance law during your early career?

Iguehi: I began my career advising on regulatory, corporate, banking, and financial matters, building a strong foundation in compliance and governance. I was later selected to join a three-person technical team working directly with the General Counsel of the Central Bank of Nigeria on complex legal matters. A standout experience was being part of the General Counsel’s team that contributed to Nigeria’s success in the USD 6.6 billion P&ID arbitral case—a complex, multi-jurisdictional matter that enhanced my strategic thinking and resilience. I also served as a member of the committee evaluating consultants for Nigeria’s comprehensive Data Protection Bill, gaining hands-on experience in regulatory drafting and governance reforms. Together, these experiences strengthened my expertise in regulatory frameworks and financial system governance.

Alaba: How has your role evolved over time, and what key milestones have you achieved in your career?

Iguehi: Over time, I have focused on high-impact projects in AML, compliance, and financial system resilience. A key milestone was authoring the chapter Addressing Illicit Financial Flows in Nigeria: The Role of AML/CFT/CPF Frameworks in the book Resilience of the Nigerian Financial System – Legal Issues, Prospects, and Challenges. These experiences have deepened my expertise in compliance, regulatory frameworks, and financial governance.

Alaba: What strategies do you use to identify and mitigate compliance risks?

Iguehi: I approach compliance risk proactively by assessing vulnerabilities, monitoring regulatory changes, and implementing strong controls. Collaboration with teams and regulators ensures solutions are practical and enforceable. Ultimately, effective risk management combines vigilance, clear processes, and a culture of accountability.

Alaba: What leadership skills or experiences have you developed in your career?

Iguehi: Working in high-stakes regulatory environments has strengthened my analytical and strategic thinking, collaboration, and decision-making skills. I have led legal reviews, contributed to cross-departmental policy discussions, and served on committees requiring the balancing of diverse stakeholder interests. These experiences honed my ability to build consensus, communicate clearly, and lead with integrity. To me, leadership is not only about giving direction but also about creating an environment where people feel empowered to contribute their best.

Alaba: How do you see the field of corporate, banking, and finance law evolving in the next 5–10 years?

Iguehi: I see corporate, banking, and finance law increasingly being shaped by technology, data, and global regulation. With AI, fintech, digital currencies, and automated compliance tools already transforming financial systems, AML and compliance frameworks are becoming more complex and data-driven. Lawyers in this space must blend legal expertise with technological literacy to anticipate risks, ensure regulatory compliance, and provide strategic, forward-looking guidance.

Alaba: Lastly, what emerging trends or technologies do you think will have the most significant impact on the industry?

Iguehi: Emerging technologies like AI, blockchain, and digital currencies are already transforming the financial sector, particularly in AML and compliance. AI-driven monitoring and analytics tools enhance risk detection, blockchain improves transparency and traceability, and digital currencies introduce new regulatory challenges. Lawyers who understand both the technology and the regulatory landscape will be best positioned to help institutions navigate these changes effectively.

Legal Business

Lexlytic and UNSBA Launch Nigeria’s First LegalTech Innovation Challenge to Spotlight the Next Generation of Legal Innovators

This Friday, a new chapter in African LegalTech begins. In partnership with the University of Nigeria Student Bar Association (UNSBA), the Nigerian LegalTech Network and Lexlytic-an emerging AI-powered legal intelligence platform, is launching the inaugural LegalTech Innovation Challenge. The one-day event will convene some of Nigeria’s brightest student minds alongside global leaders in law, policy, and technology.

The LegalTech Innovation Challenge will take place at the University of Nigeria on Friday, August 22nd. The event will feature keynotes and lightning talks on emerging trends in LegalTech, including generative AI, regulatory risk, and justice delivery innovation. At its core, the challenge is simple: identify real-world legal and regulatory challenges, and prototype bold, scalable solutions.

The pitch and essay competition has drawn attention for its depth and ambition. Shortlisted finalists will present their ideas to a stellar panel of judges and speakers, including:

- Raymond Blyd, co-founder of Legalpioneer and global leader in legal data transparency.

- Abi Odedeyi, AI strategist building safe, scalable systems for business.

- Fernandez Marcus-Obiene, product and policy powerhouse at the intersection of global tech and law.

- Chiderah Azodoh, Harvard-trained M&A expert guiding startups to $55M+ rounds.

- Iffy Nnabuenyi, infrastructure and fintech lawyer navigating billion-naira deals.

- Geoffrey Nwokolo, counsel at Yellow Card shaping digital asset law across 20 African countries.

- Chizoba Ezeani, founder of ALTIN, bridging the gap between courts and code.

- Chioma Wilson-Dike, Lexlytic co-founder decoding ESG and compliance regulations across borders.

“Innovation in African legal systems is no longer a luxury. It’s a necessity,” said Chioma Wilson-Dike, co-founder of Lexlytic. “Students are closer to the problems than most. We’re giving them the stage to propose answers.”

“We want students to see themselves not just as lawyers, but as builders,” Wilson-Dike said. “This challenge isn’t about theory. It’s about prototypes, partnerships, and policy ideas that could change the way law is practised.”

“This is just the beginning,” said a UNSBA representative. “Legal education is evolving. It’s time our institutions reflected that.”

Backed by Lexlytic’s mission to make regulation more understandable and actionable, the event is the first of many planned across African universities.

Join to attend!

Venue: Google Meet- meet.google.com/snf-mqqu-djh

Time: 2PM WAT (West African Time).

-

Oil and Gas2 days ago

Oil and Gas2 days agoTotalEnergies, Chevron Push for Faster Permits, Better Seismic Data in Africa

-

Afripreneur13 hours ago

Afripreneur13 hours agoRevolutionizing Cross-Border Payments in Africa: An Exclusive Interview with Onyinye Olisah

-

Energy2 days ago

Energy2 days agoUnited States (U.S.) Political Will, African Reforms Signal New Era for Energy Investment